Dollar Resumes Rally and Stocks Fall on Hawkish Powell Comments in Sintra

The dollar remains near the highs of this year, a significant rally was observed on Wednesday after the speech of the Fed head Powell in Sintra. After the Powell testimonial in US Congress featured with marked dovish bias there were expectations that Powell would emphasize in his Sintra speech that too aggressive tightening could hurt the economy, but the Fed chief said the US economy is in good shape and that the Fed remains committed to contain inflation. In addition, the heads of the ECB and the Fed said that the low inflation regime is a thing of the past. Accordingly, the risk that the Fed may dial back some of its hawkish plans decreased, which led to rebound of the dollar and bearish equity reaction which is set to continue today. As a result of Powell statements, the dollar index rose to the level of 105, interrupting the movement in the correctional bearish triangle:

Today, the release of the May US PCE is due - a key inflation measure for the Fed, which also gives insight into changes of consumer demand in the economy. The headline reading is expected at 4.8% YoY. In addition, there will be data on initial and continuing jobless claims, which should help to assess short-term trends in the US labor market and refine estimate for the June NFP, which will be released next Friday.

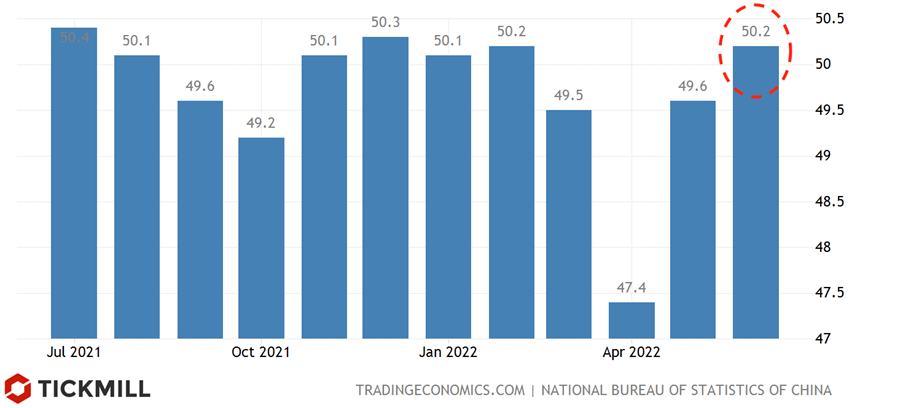

Activity in the services and manufacturing sector of China rose in June compared to May showed PMI released on Thursday. However, index components showed that full recovery will take some time.

The rebound of the non-manufacturing PMI index in June occurred primarily due to a sharp increase in activity in the construction sector, the corresponding component rose from 52.2 to 56.6 points. This indicates that the authorities are increasing investment in infrastructure, and developers with state support are increasing the pace of construction of housing and offices.

The recovery of the manufacturing sector index from 49.6 to 50.2 did not come as a surprise, given the covid relief. At the same time, the index of new orders grew from 48.2 to 50.4 points.

The hiring component showed that labor demand was lower than in May. This indicates a risk that June retail sales will fall short of expectations.

The price component in both the services and manufacturing sectors recovered poorly despite the localization of lockdowns in the country, coupled with rising costs, this means that pressure on margins rose.

In general, PMI reports showed that private demand in the economy recovered weakly in June and growth was stimulated by government purchases.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 73% and 72% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.