Dollar Consolidates After a Pullback, Traders Eye US CPI Report

High inflation and central banks’ reaction function to it continue to remain the major trading themes this week. On Wednesday, bond and FX USD markets will zero in on October US CPI report, where an upside surprise (inflation of 6% or higher), may add bearish pressure to Treasury market and lift greenback. Today, Richard Clarida will comment economic expansion and possibly express some views on current and near-term Fed policy, which will be scrutinized for hints about what the Fed will do after it completes QE next year. Rising oil prices favor resumption of USD and commodity currencies rally.

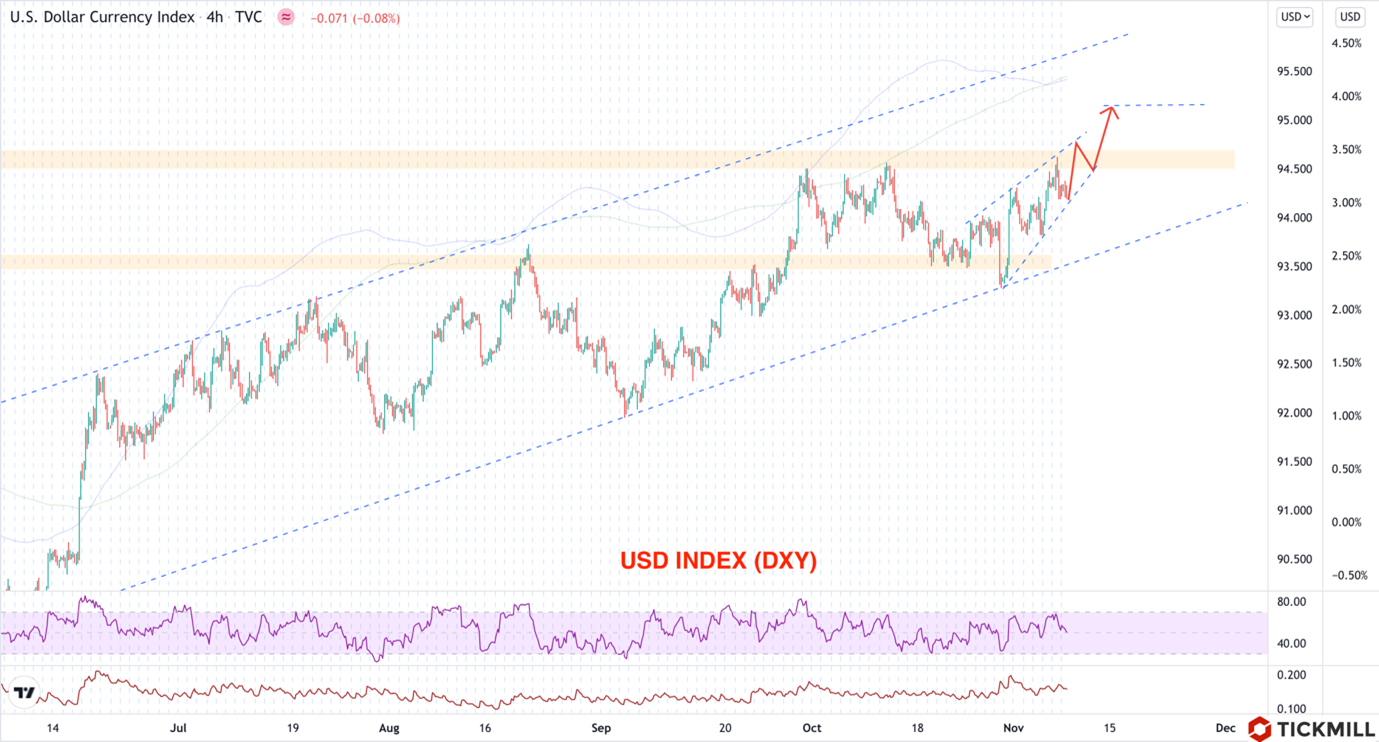

The relatively strong US labor market report for October helped greenback to flirt again with the highs of this year (94.50) on Friday, however conclusive breakout didn’t follow. It’s worth to note that November looks to be a better month for an upside breakout as seasonal headwinds increase for USD in December.

Nevertheless, the greenback may breach the key resistance area as early as this week. The move may be triggered with the release of US October CPI report. Consumer Prices are expected to rise by 5.8-5.9% YoY in October, however preliminary data such as PMI in services and manufacturing, data from the US labor market showed that input prices, wages rose in October at a faster pace compared to September. It means that slow supply adjustment to demand continues and likely exerted more pressure on consumer prices.

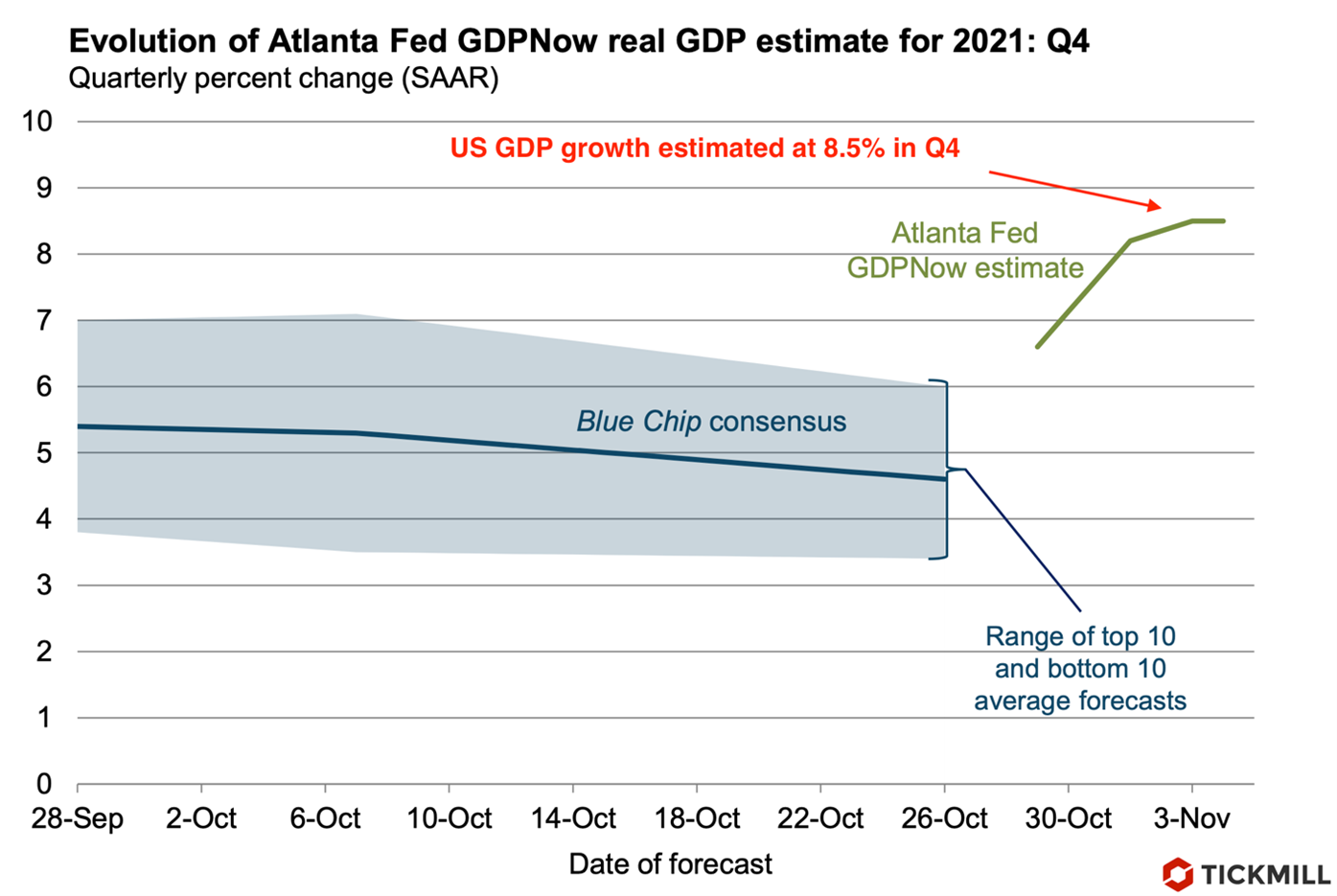

The Atlanta Fed, which calculates its own estimate of US GDP growth based on high-frequency data, has updated its forecast and assumes growth at solid 8.5% in the fourth quarter:

With such prospects for GDP growth and the Fed's shift to asset purchase tapering, the fixed income market, especially Treasuries with longer maturity could be hit again. Earlier, some Fed officials said about the risks of a slow unwinding of QE and comments of today's centrist Clarida in a similar vein may further put pressure on short-term bonds and support the dollar.

The technical picture for the dollar index (DXY) indicates high breakout potential:

OPEC's decision to gradually increase production helped oil prices rise a little more. Bullish momentum is gas prices in Europe is also gaining attention given the impact of this trend on oil prices. The upward movement of oil heats up the topic of the impact of commodity inflation on consumer prices and, accordingly, pressure on central banks to move to a tougher policy.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 73% and 72% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.