Daily Market Outlook, October 28, 2020

Daily Market Outlook, October 28, 2020

Asian equity market performance is mixed this morning after declines yesterday in Europe and on Wall Street. Concerns about the coronavirus remain a key theme. US hospitalisations have risen by at least 10% in 32 states in the past week, while the UK saw its highest death toll since May. German Chancellor Merkel said its health system could be overwhelmed. The UK’s Vaccine Taskforce Chair warned that the first generation of vaccine drugs are likely to be imperfect. Australian Q3 consumer price inflation rose by 0.7% y/y up from -0.3% in Q2, but the ‘trimmed mean’ measure held at 1.2%. The UK BRC shop price index fell 1.2% y/y in October.

Brexit talks will continue in London today before moving to Brussels on Thursday. The present round of ‘intensive’ talks are set to last until mid-November. So far this week there has been no confirmation of a breakthrough but markets seem to be increasingly confident that a deal will be reached.

In the US, preliminary September data for international trade are expected to show a third successive rise in the goods deficit. It has picked up sharply from June’s low as imports have recovered more quickly than exports post-lockdown. There are no central banks speakers today as most of the major banks are in purdah periods ahead of monetary policy meetings. However, the Dallas Federal Reserve will host a webcast with former Bank of England Governor Carney. He is unlikely to say anything about the UK policy situation. But as well as commenting on climate change policy he may touch on the wider global response to Covid-19.

The Bank of Canada will be the first of the major central banks to issue policy updates this week. After a significant easing of monetary policy in the spring, BoC policy has now been on hold for several months. That will almost certainly remain the case this month. Recent Canadian economic data has generally surprised on the upside but with Covid19 cases on the rise further policy measures are still possible. The post-announcement press conference and the BoC’s Monetary Policy Report may give some indications whether these are imminent.

The Bank of Japan will also update on monetary policy early Thursday following its latest meeting and is also expected to leave policy on hold. Recent economic data is generally seen as suggesting that economic conditions are gradually improving and the number of new Covid-19 cases seems to be decelerating. So the BoJ is likely to remain content with monitoring developments.

Citi FX Quant: The preliminary estimate of October’s month-end FX hedge rebalancing signal points to a moderate need to sell USD. At an average -0.7 standard deviations across all USD crosses, the strength of the signal is below the historical norm. The net FX impact is likely to be USD selling vs EUR and GBP at month end.

Today’s Options Expiries for 10AM New York Cut

- EURUSD: 1.1750-60 (1BLN), 1.1780-85 (700M), 1.1800-05 (1.8BLN) 1.1830 (554M), 1.1850 (319M), 1.1865-75 (800M), 1.1900 (1BLN)

- GBPUSD: 1.3000 (224M), 1.3045 (250M), 1.3100 (778M), 1.3140-45 (420M)

- USDJPY: 104.25 (345M), 104.50 (822M), 104.70-80 (760M), 104.85-90 (1.4BLN), 105.00 (1.5BLN), 105.10-15 (500M), 105.25-30 (1.2BLN)

Technical & Trade Views

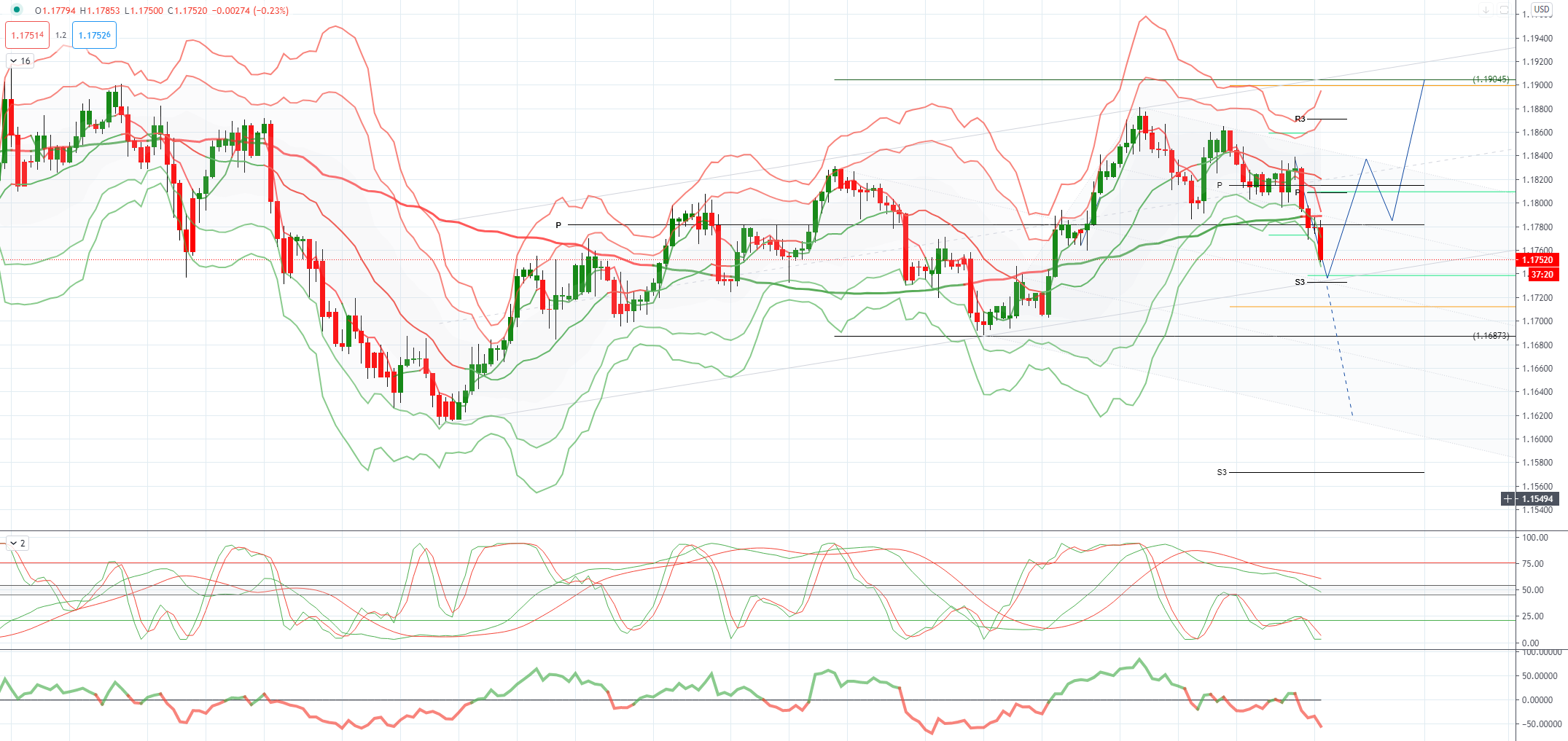

EURUSD Bias: Bullish above 1.1687 targeting 1.19

EURUSD From a technical and trading perspective, as 1.1687 supports look for a test of the primary equality objective at 1.19, expect profit taking pull back on first test.

Flow reports suggest topside offers increasing the closer the market gets to the 1.1900 level with strong offers into the area however, a break through the 1.1920 level will likely see the market gunning for the 1.2000 for the highs of the year however, option plays are likely to see good defences of the levels for the moment and any push through could be brief before dropping back again and any push for the top would have to have good timing. Downside bids light through to the 1.1780 with weak stops on a move through the level before running into congestion around the 1.1750-00 area before further stops appear and a weak downside on any break below 1.1650 area.

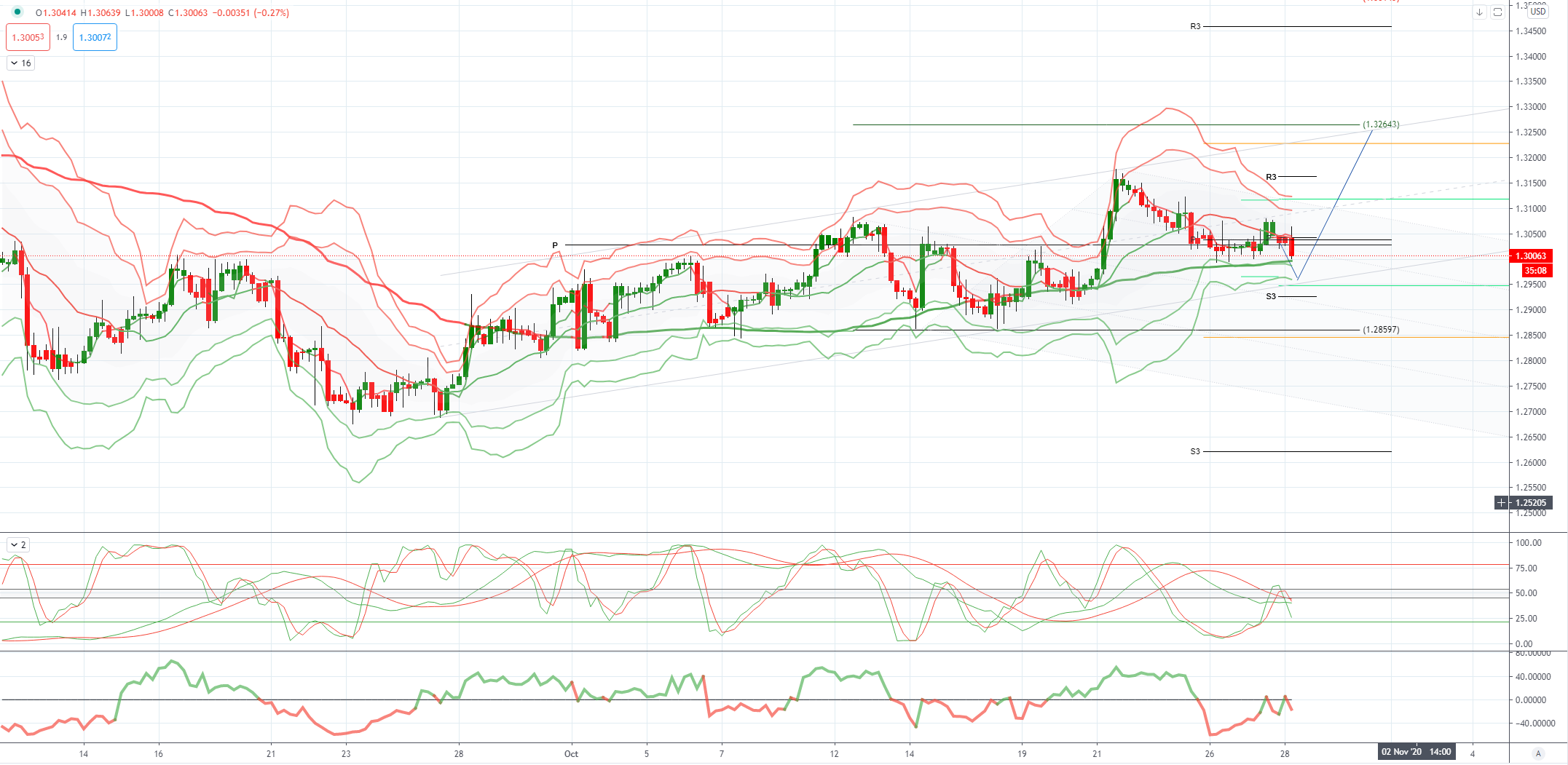

GBPUSD Bias: Bullish above 1.2861 targeting 1.3266

GBPUSD From a technical and trading perspective, while 1.2950 attracts sufficient bids look for a test of primary equality objective at 1.3264

Flow reports suggest downside bids into the 1.3000 level however, they are likely to be limited with weak stops through the level however, the move through to the 1.2950 level well likely see increasing bids and will possibly slow the market with further bids appearing into the 1.2900 level possibly significant. Topside offers light through into the 1.3150 level before stronger offers start to make an appearance and those offers are likely to increase into the 1.3200 area with limited stops on a move through and 1.3250-1.3300 area likely to be strong.

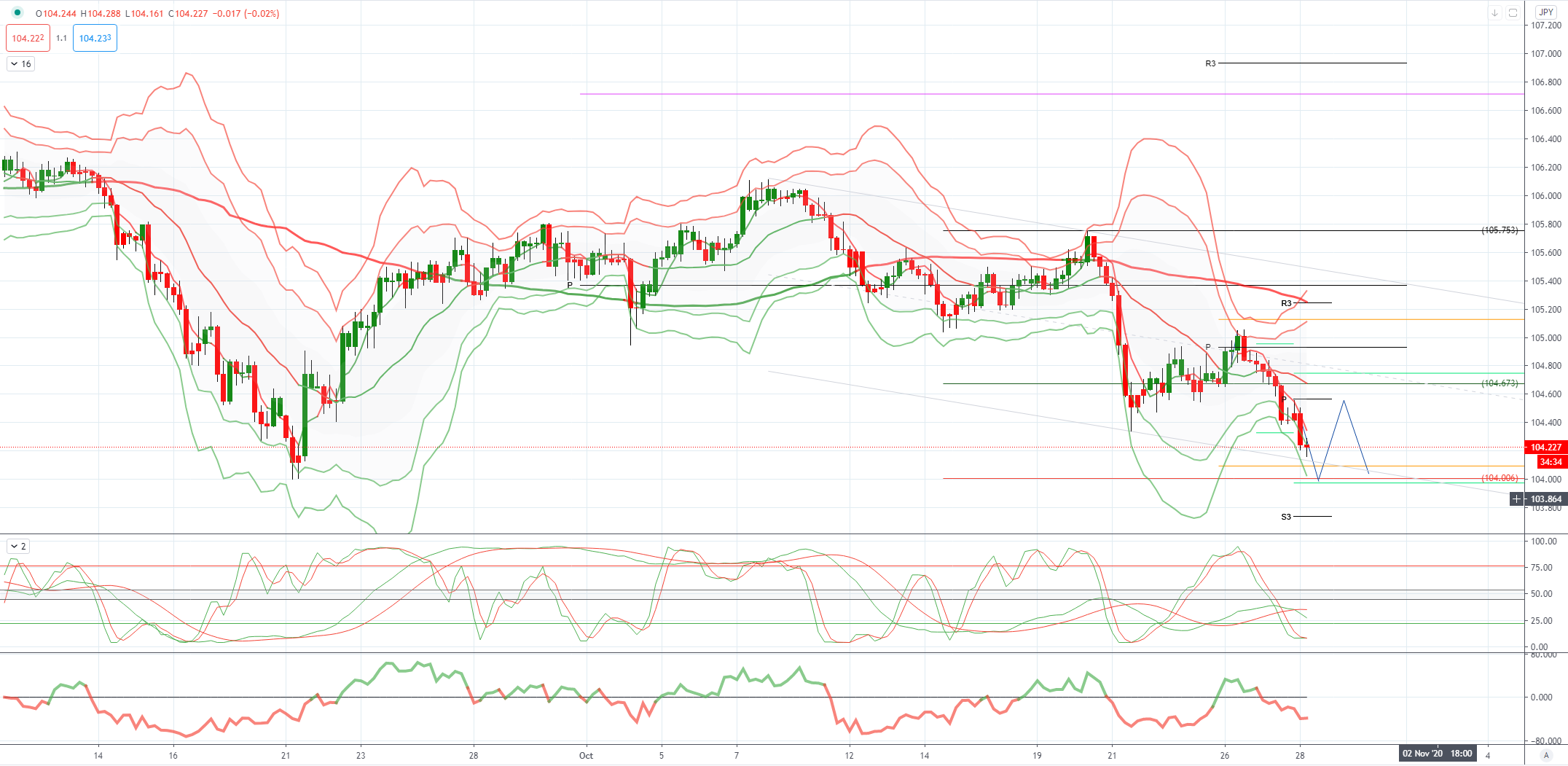

USDJPY Bias: Bearish below 104.30

USDJPY From a technical and trading perspective, as 104.30 supports look for a test of descending trendline resistance at 105.50 UPDATE breach of 104.30 opens a test of bids to 103.80

Flow reports suggest downside bids strengthen into the 104.20-00 level with possibly bottom pickers appearing below the figure level however weak stops through the 103.80 area could see a quick stab lower through to the 102.00 level before bids start to reappear. Topside offers light on a push through the 105.00 level with limited offers into the 105.80-106.20 area and the possibility of congestion then continuing through to the 106.40-80 area. And stronger offers thereafter

AUDUSD Bias: Bearish below .7243 targeting .6907

AUDUSD From a technical and trading perspective, as .7170 caps upside attempts look for decline to resume to expose bids and stops towards .6900

Flow reports suggest topside offers into the 0.7140-60 area before some light weakness appears however, 0.7180-0.7200 area sees stronger offers and 0.7220 level likely to see some congestion with stop losses through the level to open a quick move to stronger offers around the 0.7250 area. Downside bids light through to the 0.7060-40 area with stronger bids likely to appear on any move to test the 0.70000 areas, while there may be some weak stops on a move through the 0.6980 area the market is likely to see plenty of congestion into the 0.6950 area and increasing bids beyond

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 75% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

Patrick has been involved in the financial markets for well over a decade as a self-educated professional trader and money manager. Flitting between the roles of market commentator, analyst and mentor, Patrick has improved the technical skills and psychological stance of literally hundreds of traders – coaching them to become savvy market operators!