Daily Market Outlook, October 11th, 2021

Overnight Headlines

- Fed's Daly: Too Soon To Say Job Market 'Stalling' From Delta

- Goldman Cuts US Growth View On Delayed Spending Revival

- Yellen Hopeful Congress Will Pass Global Corporate Tax Deal

- GOP Leader McConnell: Will Not Again Aid Raising Debt Limit

- China Presses US To Cancel Tariffs In Test Of Bilateral Conflict

- Taiwan Pushes Back After Chinese Pres Xi Calls For Unification

- ECB’s Villeroy: Expect Inflation To Fall Below 2% By End-2022

- BoE Officials Double Down On Signals Of Imminent Rate Hike

- EU, UK Edge Closer To Trade War Over UK’s Protocol Demand

- Merkel Sees Decisive Week Ahead For Iran’s Nuclear Program

- Oil Surges Past $80, Global Power Crisis Set To Boost Demand

- SEC Throws Sop To US Investors With Bitcoin ‘Lite’ Equity ETFs

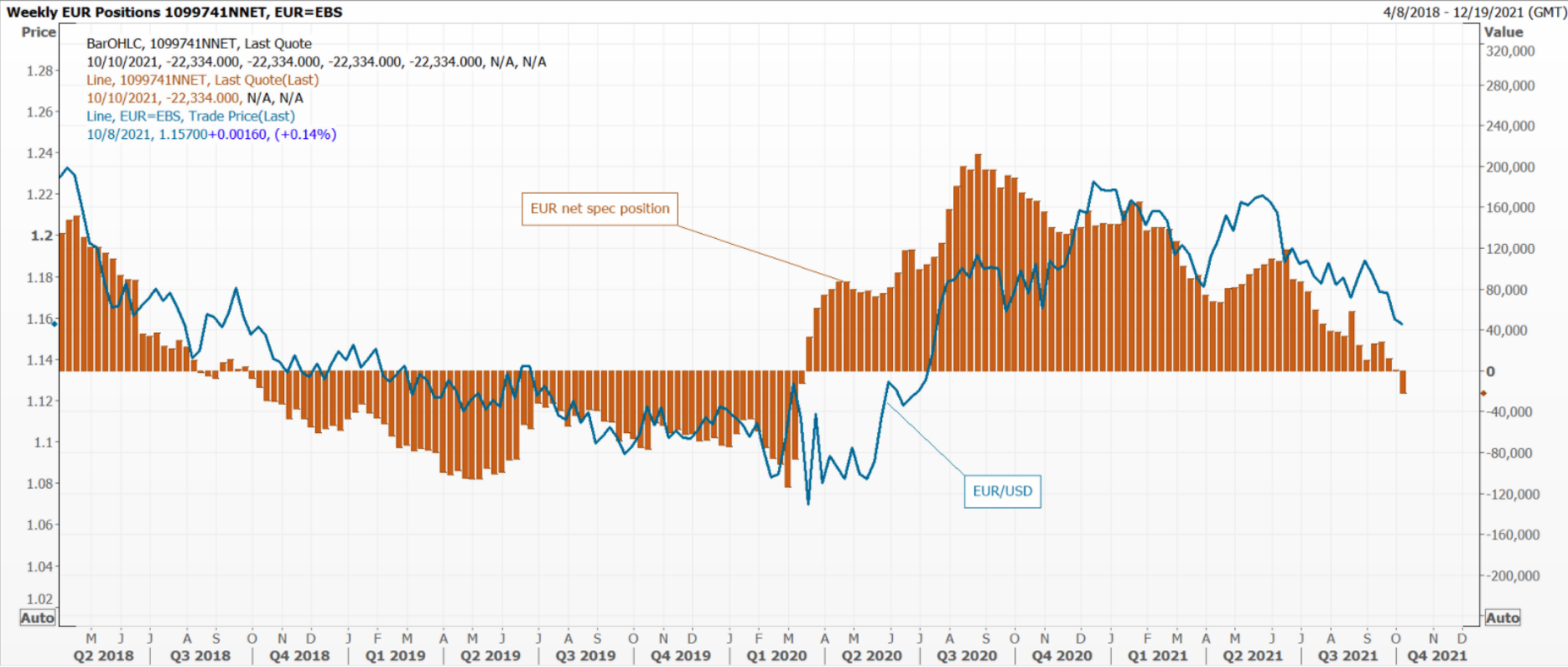

CFTC Data

- EUR turns net spec short, GBP as well

- EUR net spec positioning turns short for first time since March 2020

- EUR net spec short 22,334 vs previous long of just 872 contracts

- JPY net spec short 63,694 vs previous short 64,760

- AUD net spec short posts latest in series of highs at 89,979 vs previous short 86,383

- GBP short again by 20,018 -- first time in four weeks -- vs previous week's long 1,964

The Week Ahead

- Inflation reports and Fed minutes in focus With global yields on the rise, attention shifts to key inflation reports out of the U.S. and China this week. The market will also focus on the Federal Reserve minutes for confirmation the Fed will begin tapering their asset purchases. U.S. earnings season kicks off as well, with major banks such as Citigroup, Bank of America and JPMorgan Chase reporting. The earnings and outlooks of leading U.S. companies will likely determine the path of equity markets for the final quarter of 2021.

- On the data front, CPI and PPI will be the main events in the U.S. this week. Retail sales, weekly jobless claims and University of Michigan consumer sentiment are also due. It will be a quiet week for data out of the euro zone with trade, industrial production, German ZEW and CPI the key events. The UK is busier, with employment, August GDP, trade data and industrial output on tap. China has CPI and PPI, along with the closely watched trade data for September. Lending data may also be released this week. Japan's main release is machinery orders. Employment data will be the key event in Australia this week, with the NAB business survey also due. No top-tier data is scheduled in New Zealand or Canada.

G10 FX Options Expiries for 10AM New York Cut

(Hedging effect can often draw spot toward strikes pre expiry if nearby)

- USDJPY - 111.90/112.00 420m. 111.40/50 410m. 110.90/111.00 825m. 109.70/80 590m.

- EURUSD - 1.1750/60 509m. 1.1620 679m. 1.1590/1.1600 1.55bn (1.15bn C). 1.1530/50 1.26bn (1.19bn P). 1.1490/1.1500 425m.

- AUDUSD - 0.7360 413m. 0.7180/90 448m.

- USDCHF - 0.9220 757m. 0.9000 476m.

- USDCNH - 6.55 666m. 6.50 858m. 6.46 457m. 6.43 760m. 6.42 592m.

Technical & Trade Views

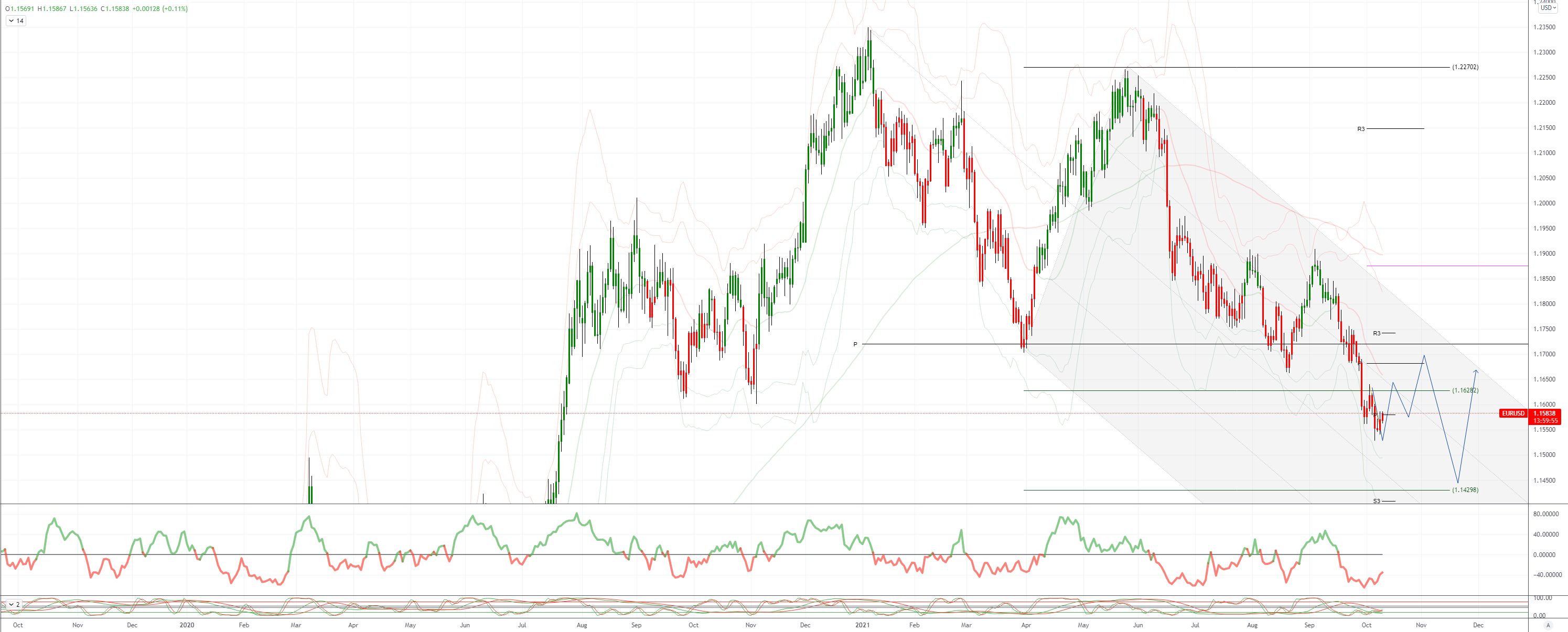

EURUSD Bias: Bearish below 1.17 Bullish above

- EUR/USD opened 1.1565 after closing Friday up 0.18% at 1.1575

- The range in Asia was 1.1563/84 and is around 1.1570 into the afternoon

- EUR/USD trending lower with the 5, 10 and 21-day MAs in a bearish alignment

- A break above the 10-day MA at 1.1592 would ease the downward pressure

- Support is @ last week's low @ 1.1529 and 50% of 1.0636/1.2349 move @ 1.1492

- It is a partial holiday in the US so price action may be muted in Europe

GBPUSD Bias: Bearish below 1.36 Bullish above.

- GBP/USD rises to 13 – day high on hawkish Bailey and Saunders

- Cable climbs to 1.3672 on hawkish weekend comments from Bailey and Saunders

- BoE governor told Yorkshire Post that UK CPI above 2% target is concerning

- Saunders: Get ready for early BoE rate rise

- 1.3672 = highest level since Sept 28 (1.3661 was Friday's high, post-NFP)

- Offers may emerge ahead of 1.3700 (and 1.3750) if GBP/USD extends north

- IMM speculators flipped to net GBP short in week ended Oct

USDJPY Bias: Bullish above 109 Bearish below

- USD/JPY and JPY crosses bid in Asia, USD/JPY leads complex higher

- USD/JPY 112.18 to 112.72 EBS in Asia, offers few, far between

- Move up in tandem with US yields post-US NFP miss, convexity flows

- Reports more hedging of US portfolios after US Tsy 10s break above 1.60%

- Nikkei up too, correlation back on? Talk Kishida to hold off on stock tax

- Japanese exporters conspicuous in absence, only offers on profit-takes

- Reports USD/JPY stops tripped 112.40-50+, more 113.00+

AUDUSD Bias: Bearish below 0.75 Bullish above

- AUD/USD opened 0.7303 after closing Friday at 0.7309

- It fell to 0.7292 early Asia when e-minis fell over 0.50%

- Price reversed after Asia fully arrived and Nikkei rose over 1.50%

- AUD/USD marched up to 0.7331 before easing back to 0.7320/25

- Resistance is at Friday's 0.7338 high and 61.8 of 0.7477/0.7170 at 0.7360

- Support is at the 21-day MA at 0.7277 and 10-day MA at 0.7267

- IMM data released Friday showed net AUD shorts at extreme levels

- A break above 0.7360 could see short-covering accelerate

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 73% and 72% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

Patrick has been involved in the financial markets for well over a decade as a self-educated professional trader and money manager. Flitting between the roles of market commentator, analyst and mentor, Patrick has improved the technical skills and psychological stance of literally hundreds of traders – coaching them to become savvy market operators!

.png)