Daily Market Outlook, July 28, 2020

Daily Market Outlook, July 28, 2020

Asian equity market is mostly up this morning but overall markets are continuing to trade cautiously ahead of this week’s US Fed policy meeting and a raft of earnings numbers. In the UK, Chancellor of the Exchequer Sunak is reportedly considering a new online sales tax to increase revenues and boost the competitiveness of high street retailers. Meanwhile, UK government advice against nonessential travel to Spain has been updated to include the Balearic and Canary Islands.

The July UK Lloyds Business Barometer, released this morning, showed a second consecutive monthly increase. It rose eight points to a four-month high of -22%, although that is still a historically low level. Expectations regarding both own business prospects and the wider economy improved. Less positively there was only a slight gain in employment prospects, which remained very low. Business confidence rose in all but two regions and in most sectors. The negative impact from Covid-19 was still high but down from previous readings.

The rest of today’s data calendar is very light. In the UK, the July CBI retail survey will provide a timely update on high street spending. The much stronger-than-expected rise in June retail sales confirmed that there was an initial burst of pent-up demand as lockdown measures were eased. However, this first report for July will be watched for any confirmation of anecdotal reports that point to a subsequent slowdown. In the US, the Conference Board’s measure of consumer confidence may provide further indications of whether the economy’s rebound from lockdown has slowed in July. The already released alternative indicator consumer sentiment from the University of Michigan showed a large drop led by a decline in expectation. Expect a similar fall in today’s measure.

The US Federal Reserves’ latest monetary policy meeting starts today with the result set to be reported tomorrow evening. Meanwhile, discussions continue in Washington over another fiscal stimulus package. Republican Congressional leaders revealed their proposals yesterday but they still seem some way from agreement with the Democrats. The talks are given added urgency by the fact that Congress is supposed to recess for the summer at the end of the week and that some previous fiscal stimulus measures are set to soon run out.

CITIFX QUANT: Month-End Asset Rebalancing: July 2020 Estimate

- The asset rebalancing signal notes a mild rotation from equities to bonds with a very weak signal at month end.

- More interestingly intra asset rebalancing—such as outflows from US equities and inflows in UK and European equities or inflows into all but UK and European bonds—are likely to occur, albeit with weak signals overall.

- The FX signal from the rebalancing flows suggests USD selling against EUR at month end.

Today’s Options Expiries for 10AM New York Cut (notable size in bold)

- EURUSD: 1.1685 (442M)

- USDJPY: 105.60-65 (300M), 106.00 (600), 106.50 (300M), 106.85 (420M)

- AUDJPY: 74.00-10 (1BLN), 0.7425 (460M)

Technical & Trade Views

EURUSD Bias: Bullish above 1.16 targeting 1.1830

EURUSD From a technical and trading perspective, as 1.16 acts as support look for a test of the 1.1830 equality objective before a profit taking pause. A closing breach of 1.1550 would concern the near term bullish bias opening a deeper correction to 1.1450 UPDATE note Citi month end EUR buy signal, pullbacks to 1.1650/00 should see bids to take to price into a test of the pivotal 1.183/50 as discussed in today's Chart Hit

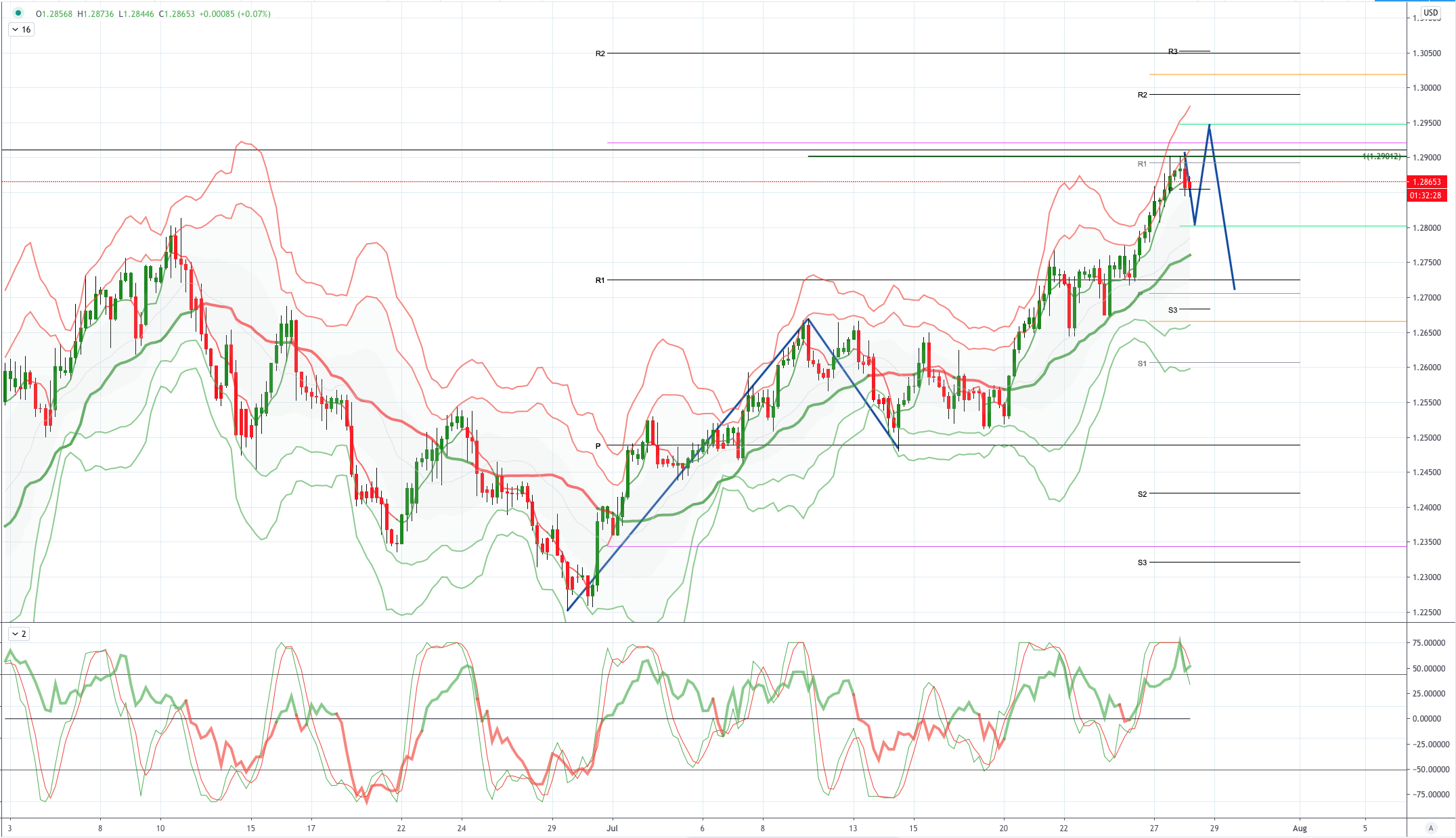

GBPUSD Bias: Bullish above 1.28 targeting 1.2950

GBPUSD From a technical and trading perspective, as 1.25 attracts sufficient demand, look for a grind higher to test offers and stop at 1.28. A closing breach of 1.25 suggests return to range and a test of range support at 1.2250.UPDATE target achieved, as 1.29 contains the rally look for a pullback to test 1.27 support.UPDATE price stalling at equality objective at 1.29 as 1.28 supports look for a test of offers and stops to 1.2950 before a pullback to 1.27

USDJPY Bias: Bearish below 106.30 targeting 104.50

USDJPY From a technical and trading perspective, anticipated test of the equality objective at 108.13 saw bearish reversal patterns, setting up a move for another test of 106 enroute to a pivotal 105 test UPDATE equality objective achieved as 107.30 caps the upside look for a retest of 106.30’s UPDATE 106.30 achieved as 106.75 now acts resistance lok for a test of 104.50’s

AUDUSD Bias: Bullish above .7090 targeting .7220

AUDUSD From a technical and trading perspective, as .7100 now acts as support, look for a move to testing projected ascending trendline resistance .7220 next leg higher to test stops and offers above .7220 before a corrective phase to test .6950 as support.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 73% and 76% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

Patrick has been involved in the financial markets for well over a decade as a self-educated professional trader and money manager. Flitting between the roles of market commentator, analyst and mentor, Patrick has improved the technical skills and psychological stance of literally hundreds of traders – coaching them to become savvy market operators!