Daily Market Outlook, July 24, 2023

Daily Market Outlook, July 24, 2023

Munnelly’s Market Commentary…

Asian equity markets started the week on a positive note, but gains were limited due to uncertainty ahead of key risk events. US equity futures also showed a non-committal tone as investors await the outcomes of upcoming monetary policy meetings by the Federal Reserve (FOMC), European Central Bank (ECB), and Bank of Japan (BoJ). Additionally, big tech earnings results are also anticipated from Microsoft and Alphabet. The Nikkei 225 in Japan rose, buoyed by reports suggesting that the BoJ is likely to keep its yield curve control policy unchanged at the upcoming meeting and sees little immediate need to act on YCC. The Hang Seng in Hong Kong declined while the Shanghai Composite in mainland China posted a marginal gain. Hong Kong's market was pressured by weakness in the property sector and tech stocks, while the mainland market was indecisive as the National Development and Reform Commission's (NDRC) notice to promote high-quality development of private investment countered reduced hopes for aggressive stimulus measures following China's politburo meeting, where top officials reviewed the economic performance for the first half of the year.

The results of Sunday's election in Spain did not provide a clear majority for either of the main parties, the PP (People's Party) or the Socialists, in the 350-seat congress. Neither party secured the 176 seats needed for a majority, leading to an inconclusive outcome. As a result, Spanish equity futures have been negatively affected by the uncertainty, with the prospect of another election later in the year looming. The inconclusive election outcome has raised concerns among political analysts about the possibility of ongoing political instability and the potential for further uncertainty in the Spanish political landscape. The lack of a clear majority in the congress could make it challenging for any party to form a stable government, and the possibility of a subsequent election later in the year adds to the uncertainty in the markets.

Global flash PMIs for July, the U.S. The Federal Reserve's favoured inflation gauge and Australian consumer inflation data will be in the spotlight as traders look for signs that central banks are nearing the end of aggressive rate-hiking cycles. The U.S. core PCE price index, which is known to influence the Fed's rate path, is released Friday and is expected to have risen 4.2% annually in June, cooling from 4.6%. Advance Q2 GDP on Thursday is expected to post a 1.7% quarterly rise. Other U.S. data includes PCE consumption, personal income, durable goods employment cost index, consumer confidence, new home sales, flash S&P Global PMIs, weekly jobless claims and University of Michigan consumer sentiment. Data from the Eurozone includes flash July PMIs, economic sentiment and consumer confidence, the German Ifo survey and preliminary inflation for July.

For the UK, there are expectations of a further easing in both manufacturing and services momentum in July. The manufacturing sector is forecasted to register a 12th consecutive reading below 50, indicating a contraction in activity. Recent data from the UK Sector Tracker, which analyses PMIs at a more detailed level, showed that 5 out of 7 pure-play manufacturing sectors experienced declines in activity in June, suggesting a broader slowdown. Notably, the Orders-to-Inventory Ratio, a closely watched indicator, dropped to a six-month low, indicating that manufacturers may need to reduce production in the coming months to avoid accumulating excessive stock. As a result, the forecast for the manufacturing PMI in July is a decline to 46.0 from June's reading of 46.5. Similarly, for the UK services PMI, there is an expectation of a drop in the headline balance from 53.7 to 53.3. This is attributed to signs of a recent softening in demand for services in the UK economy.

CFTC Data As Of 18-07-23

USD net spec short grew in the Jul 12-18 period amid a $IDX 1.65% slide

EUR$ +2% in period, specs +38,670 into strength, now long 178,832 contracts

$JPY -1.05%, specs +26,943 contracts, short reduced to -90,239

GBP$ +0.77%, specs +5,666 contracts now +63,729; data pre-UK CPI Wednesday

AUD$ +1.88%, specs -5,317 now -50,401 contracts; $CAD -0.46% specs -3,923

BTC -2.6% in period specs buy 694 contracts on dip, now -1,161 contracts

Note since Tuesday reporting period close the $IDX is down near 0.9%

EUR$ has dipped 0.88%, $JPY rose 2.11% after period closed leaving recent EUR & JPY buyers in the red(Source: Reuters)

FX Options Expiries For 10am New York Cut

(1BLN+ represent larger expiries, more magnetic when trading within daily ATR)

EUR/USD: 1.1015-25 (702M), 1.1075 (200M), 1.1130 (638M)

1.1175-80 (479M), 1.1250 (324M)

USD/JPY: 140.00 (2.0BLN), 140.25 (500M), 140.75 (260M)

141.00 (200M), 141.25-29 (1.17BLN), 142.00-10 (869M)

GBP/USD: 1.2785-95 (449M), 1.294-50 (1.0BLN), 1.2975 (343M)

EUR/GBP: 0.8475 (1.4BLN), 0.8500 (235M), 0.8600 (950M)

0.8625-30 (339M)

AUD/USD: 0.6720 (430M), 0.6780 (432M), 0.680-05 (1.32BLN)

NZD/USD: 0.6000-10 (386M), 0.6160 (1.0BLN)

USD/CAD: 1.3180-90 (314M), 1.3350 (225M)

Options Market Positioning

FX option volatility risk premiums remain elevated as the U.S. dollar recovers lost ground ahead of this week's central bank decisions from the United States, Eurozone and Japan. One-week expiry options have been influenced by the Federal Reserve and European Central Bank decisions, contributing to the initial boost in implied volatility. Additionally, with the inclusion of the Bank of Japan in the one-week expiry, there have been significant gains in Japanese yen (JPY) related implied volatility and premiums for JPY calls over puts. This indicates that the market is not ruling out potential easing by the Bank of Japan, despite official rhetoric suggesting otherwise. EUR/USD is currently consolidating in the low 1.11s after reaching a recent peak of 1.1274. The entire implied volatility curve for EUR/USD remains above recent lows, and risk reversals have recovered some downside strike premium. However, the barrier at 1.1300 remains challenging for EUR/USD to break through.

Overnight Newswire Updates of Note

Asia Shares Brace For Trio Of Rate Meetings, China Steps

US Futures Flat Ahead Of Busy Week Of Earnings, Fed Meeting

Fed Readies Another Rate Hike In Pivotal Week For Central Banks

US Economic Soft Landing Hinges On Fed’s Tolerance Of Inflation

Blinken Says World Is Seeking Responsible US-China Relationship

China Target Key Sectors For Private Investment To Boost Growth

Japan's FX Diplomat: Inflation, Wage Gains Exceeds Expectations

Tories Urge Sunak To Alter Strategy, Cabinet After Election Losses

UK Job Vacancies Rise In Fifth Month, Adding To Pressure On Pay

European Central Banks Could Speed Up Bond Sales, Say Experts

Sanchez Hold Upper Hand After Late Surge Thwarts Spanish Right

Dollar Bearish Bets Climb To Record High Among Asset Managers

Chevron Records $6 Billion Quarterly Earnings, Beating Estimates

Stellantis, Samsung SDI Confirm To Build Second US Battery Plant

(Sourced from Bloomberg, Reuters and other reliable financial news outlets)

Technical & Trade Views

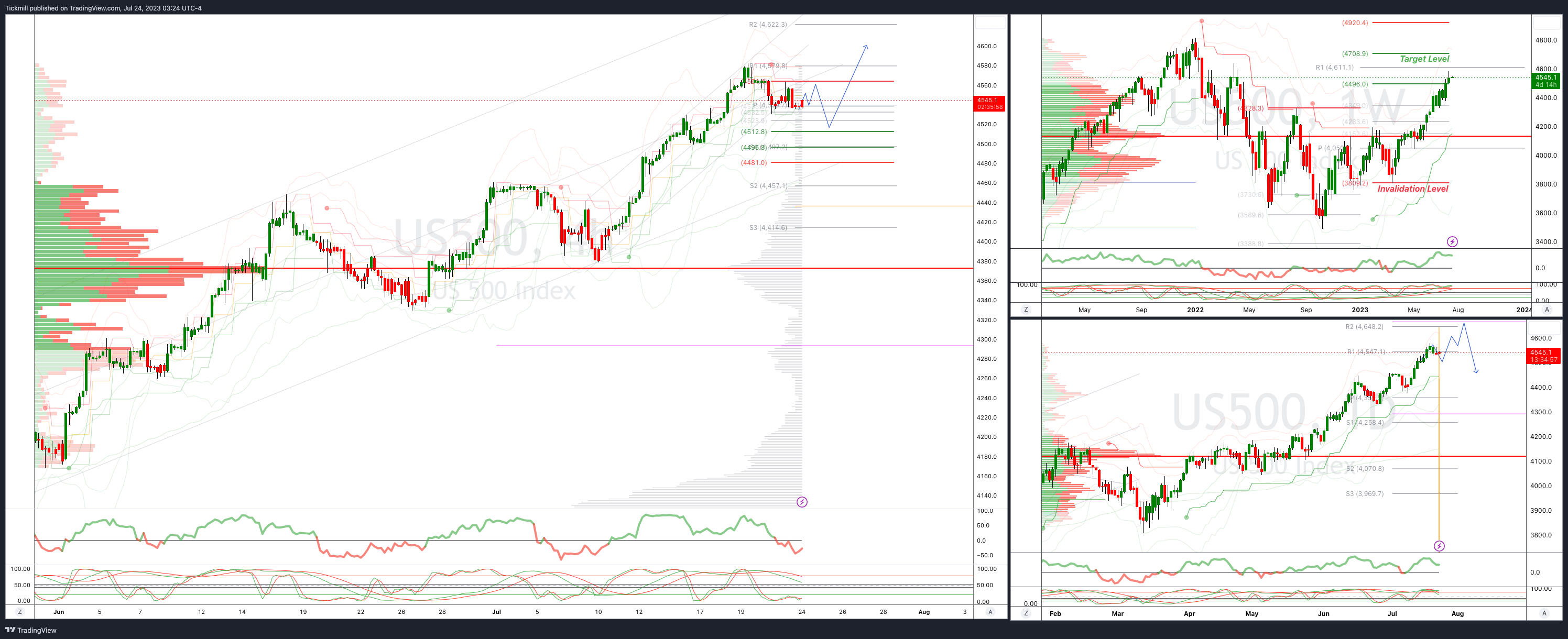

SP500 Intraday Bullish Above Bearish Below 4560

Below 4530 opens 4512

Primary support is 4370

Primary objective is 4630

20 Day VWAP bullish, 5 Day VWAP bearish

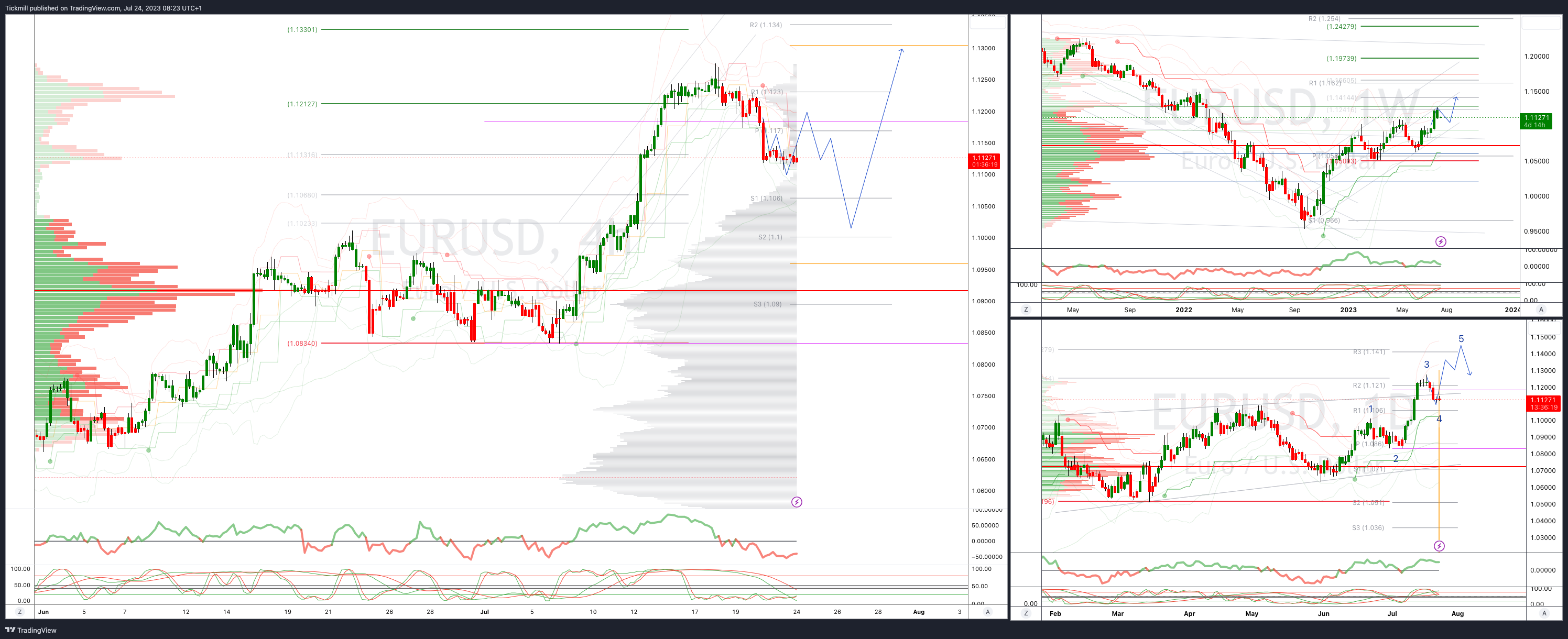

EURUSD Intraday Bullish Above Bearsih Below 1.12

Below 1.1150 opens 1.1050

Primary support is 1.10

Primary objective is 1.13

20 Day VWAP bullish, 5 Day VWAP bearish

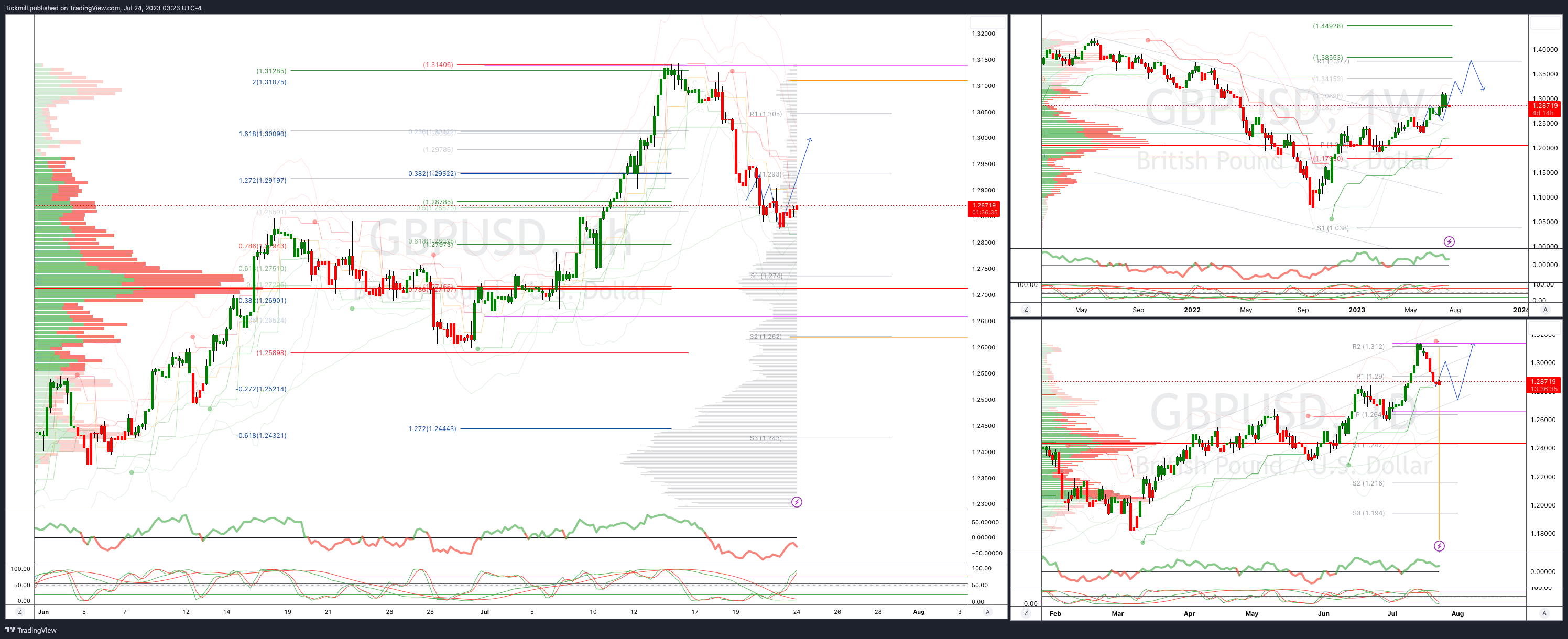

GBPUSD: Intraday Bullish Above Bearish Below 1.2850

Below 1.2830 opens 1.2710

Primary support is 1.26

Primary objective 1.3850

20 Day VWAP bullish, 5 Day VWAP bearish

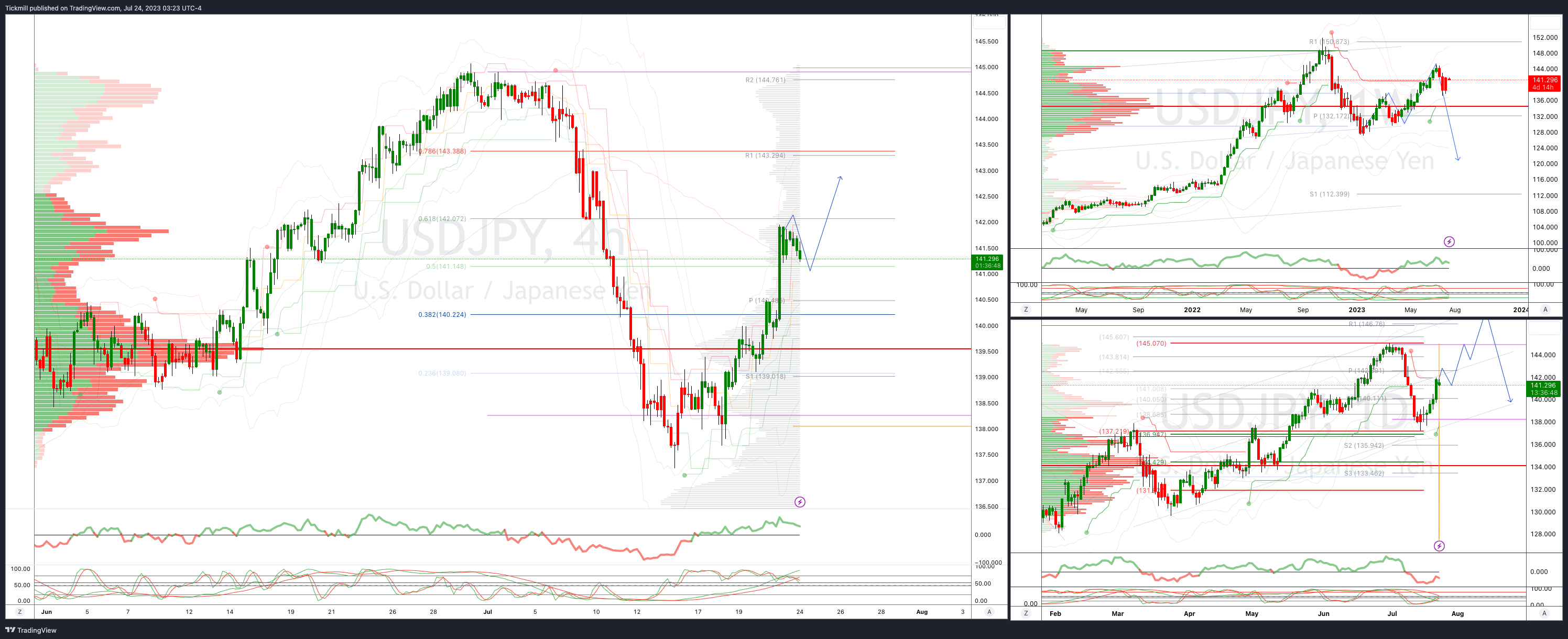

USDJPY Bullish Above Bearish Below 139.60

Above 143.50 opens 145

Primary resistance 143.40

Primary objective is 136.20

20 Day VWAP bearish, 5 Day VWAP bullish

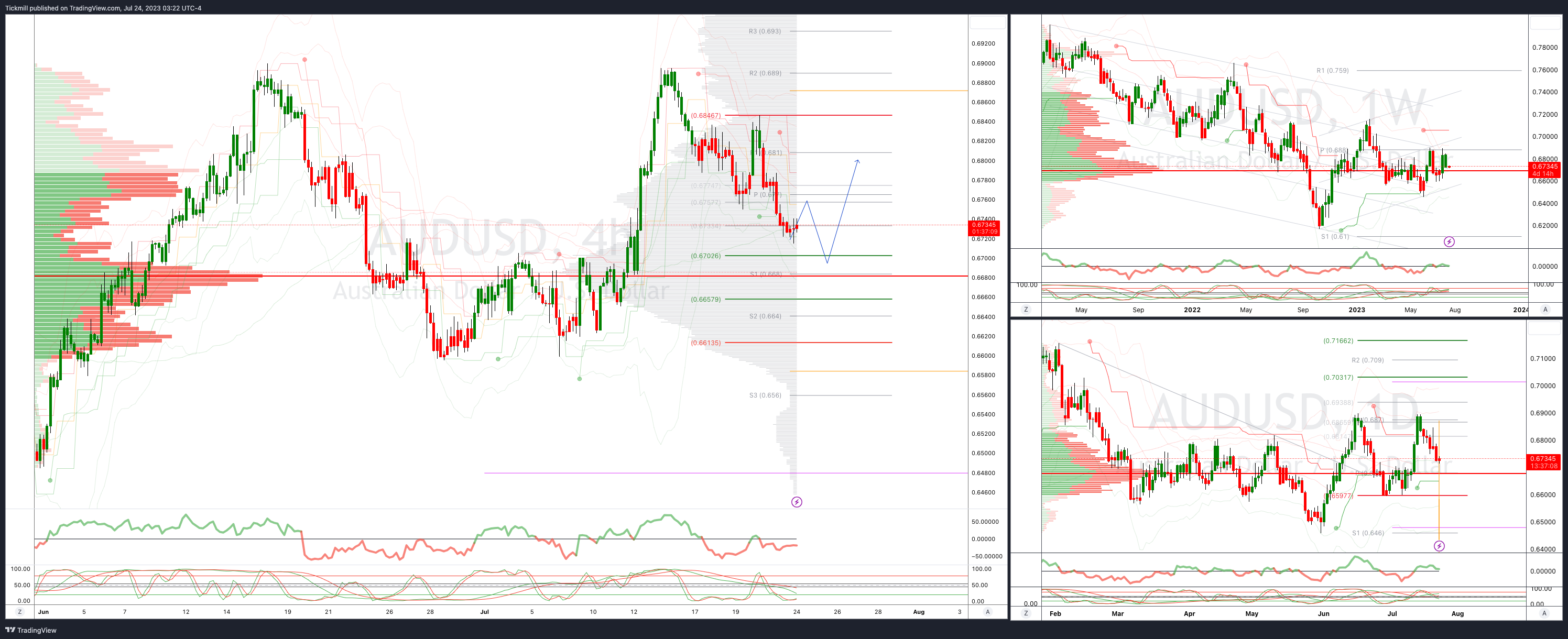

AUDUSD Intraday Bullish Above Bearish Below .6800

Below .6795 opens .6700

Primary support is .6448

Primary objective is .7000

20 Day VWAP bearish, 5 Day VWAP bearsih

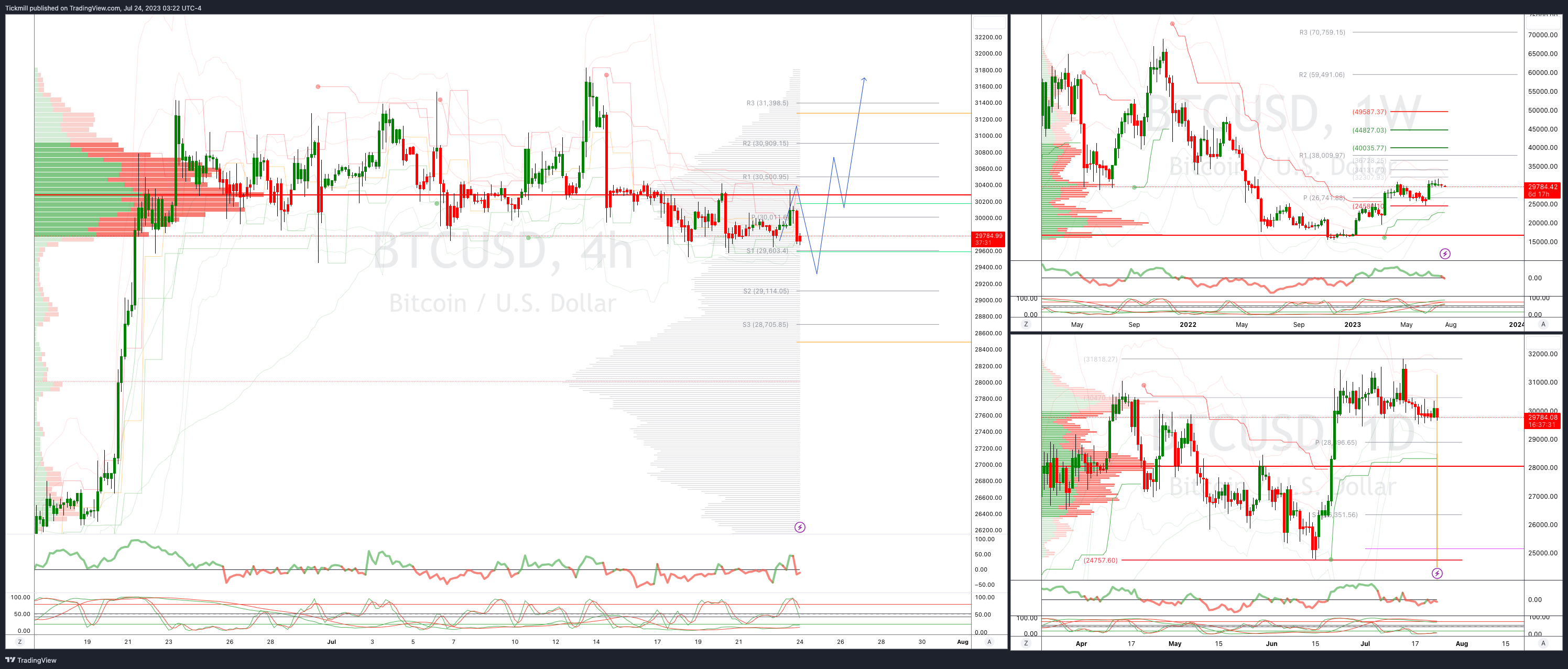

BTCUSD Intraday Bullish Above Bearish below 30000

Below 29400 opens 28600

Primary support is 28400

Primary objective is 32750

20 Day VWAP bullish, 5 Day VWAP bearish

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

Patrick has been involved in the financial markets for well over a decade as a self-educated professional trader and money manager. Flitting between the roles of market commentator, analyst and mentor, Patrick has improved the technical skills and psychological stance of literally hundreds of traders – coaching them to become savvy market operators!