Daily Market Outlook, July 04, 2023

Daily Market Outlook, July 04, 2023

Munnelly’s Market Commentary…

Wall Street saw slight gains in a range bound trading session ahead of the Independence Day holiday. The market remained cautious, and upside momentum was limited. Investors digested the weak US ISM Manufacturing PMI data as holiday-thinned trading conditions pinned the price action. Asian markets traded with mixed results, mostly range bound amid the subdued activity in the US markets. The ASX 200 initially showed caution ahead of the Reserve Bank of Australia (RBA) rate decision. Analysts saw the decision as a close call, but the central bank ultimately kept rates unchanged at 4.10%. This decision provided support to the ASX 200, which gained 0.4%.

The Nikkei 225 underperformed, slipping below the 33.5K handle. The decline was also influenced by a pullback in USDJPY from its recent peaks. Meanwhile, the Hang Seng and Shanghai Composite posted gains, albeit with limited upside due to trade frictions. China's announcement to ban exports of gallium and germanium-related products from August 1st, which are used in high-performance chips, added to the concerns. US Treasury Secretary Yellen had a productive discussion with China's ambassador, addressing areas of concern and emphasising the importance of collaboration between the two countries. Maintaining open lines of communication was a key topic of discussion.

With US markets offline today and a scant European data docket investors will start to focus on a combination of economic data and second-quarter earnings as they seek fresh trading cues. However, there is a level of uncertainty surrounding the policy path of the U.S. Federal Reserve. Wednesday’s release of the minutes from the Fed's last meeting could offer further insights into the central bank's policy direction. These minutes have the potential to introduce some volatility into the market as investors analyse the information and adjust expectations accordingly.The minutes precede Friday's non farm payrolls data which is expected to be the major macro catalyst of the holiday shortened week, according to a Reuters poll, the forecast for June's non-farm payrolls suggests a moderation to 225,000 from May's figure of 339,000. The unemployment rate is expected to remain steady at 3.7%. Average hourly earnings are projected to increase by 0.30% month-on-month, matching May's figure, and by 4.2% year-on-year, slightly lower than the 4.3% recorded in May.

CFTC Data As Of 30-06-23

USD IMM net spec short in the Jun 21-27 reporting period; $IDX -0.02%

EUR$ +0.38% in period, specs stayed on sidelines +379 contracts now +145,028

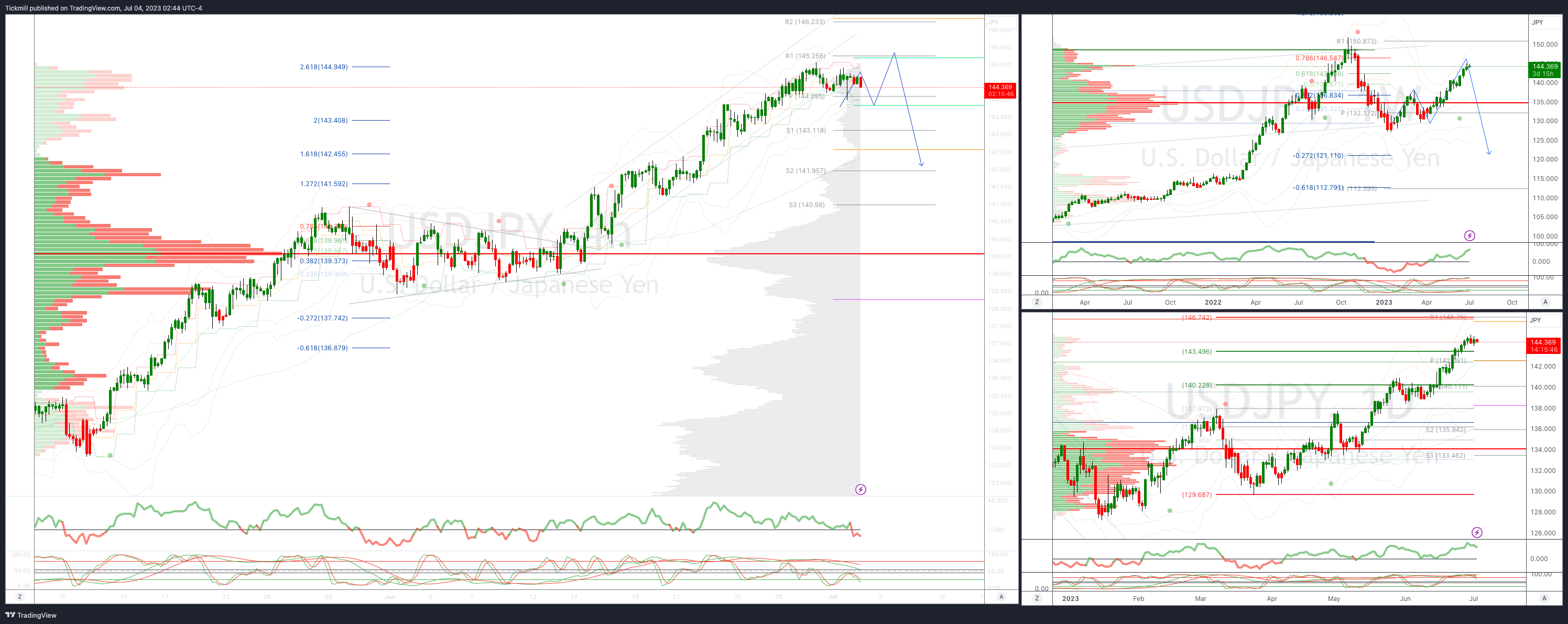

$JPY rose 1.91%, specs -5,214 contracts now -112,870 as BoJ remains steady

Recent test of 145, tipped intervention area may stir long profit-taking

GBP$ -0.1%, specs +5,386 contracts now +51,994 on rising UK rate view

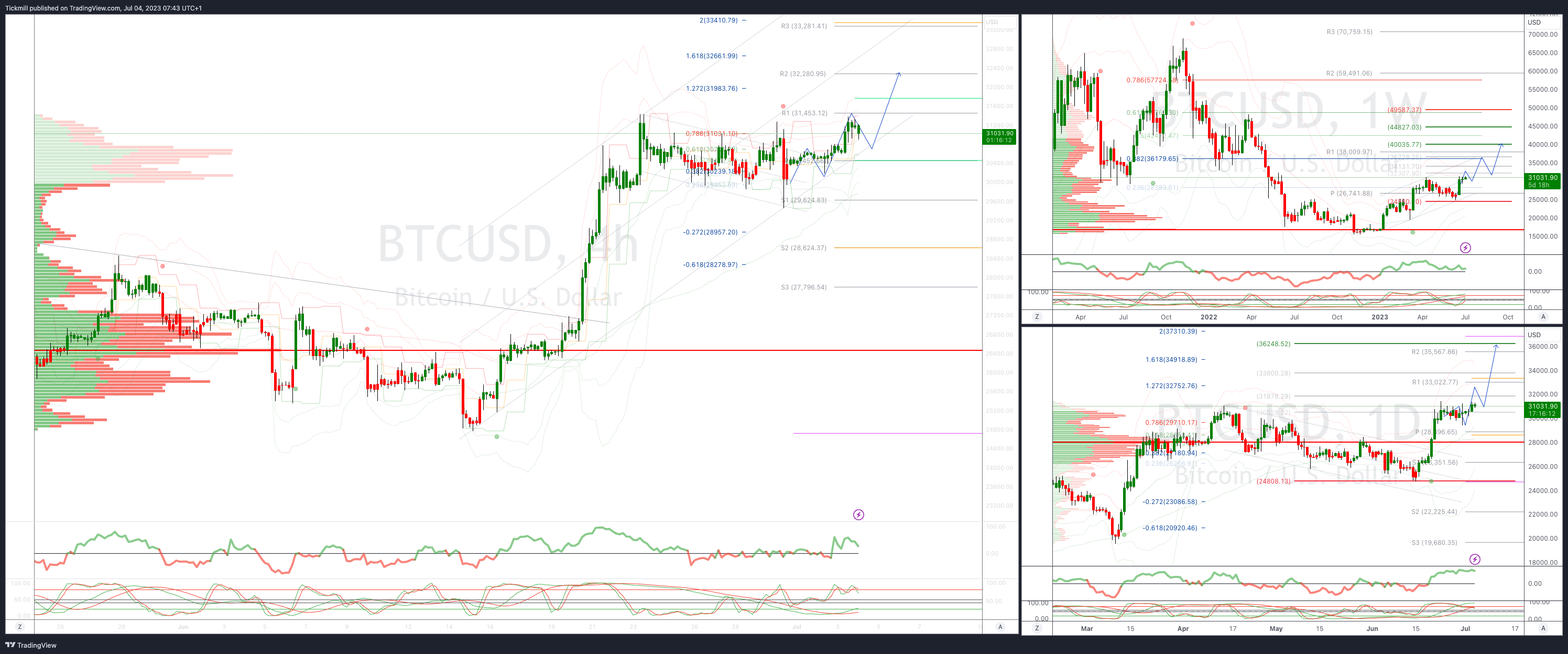

BTC rose 8.86%, specs sold 2,491 contracts into strength, flip to -2,094

$CAD -0.31% in period, specs +30,696 contracts short pared to -2,847

AUD$ -1.49% in period, specs +10,192 contracts now -39,424

BoC, RBA had been considering further rate hikes amid persistent inflation

Inflation stalling has weakened CAD and AUD since Jun 21, may see recent longs lighten(Source: Reuters)

FX Options Expiries For 10am New York Cut

(1BLN+ represent larger expiries, more magnetic when trading within daily ATR)

EUR/USD: 1.0750 (495M), 1.0760-65 (711M), 1.0785-90 (1.18BLN)

1.0840-50 (225M)

USD/CHF: 0.8965 (200M)

GBP/USD: 1.2600 (242M), 1.2670 (299M)

AUD/USD: 0.6605-10 (456M)

Overnight News of Note

Reserve Bank Of Australia Leaves Official Cash Rate Steady At 4.1%

US Looks To Restrict China’s Access To Cloud Computing To Protect Adv Tech

China Hits Back With Export Curbs On Chipmaking Materials

Japan's Currency Diplomat: Tokyo In Constant FX Dialogue With US

NZ Firms Are Downbeat On Economy, Sales As Growth Slows

Oil Edges Higher After Saudi Arabia And Russia Curb Supplies

Rally In Global Shares Halted; Aussie Falls On RBA’s Pause

Meta Set To Release Twitter Competitor Soon Called Threads

Adobe’s $20 Billion Takeover Of Figma Faces EU Merger Review

(Sourced from Bloomberg, Reuters and other reliable financial news outlets)

Technical & Trade Views

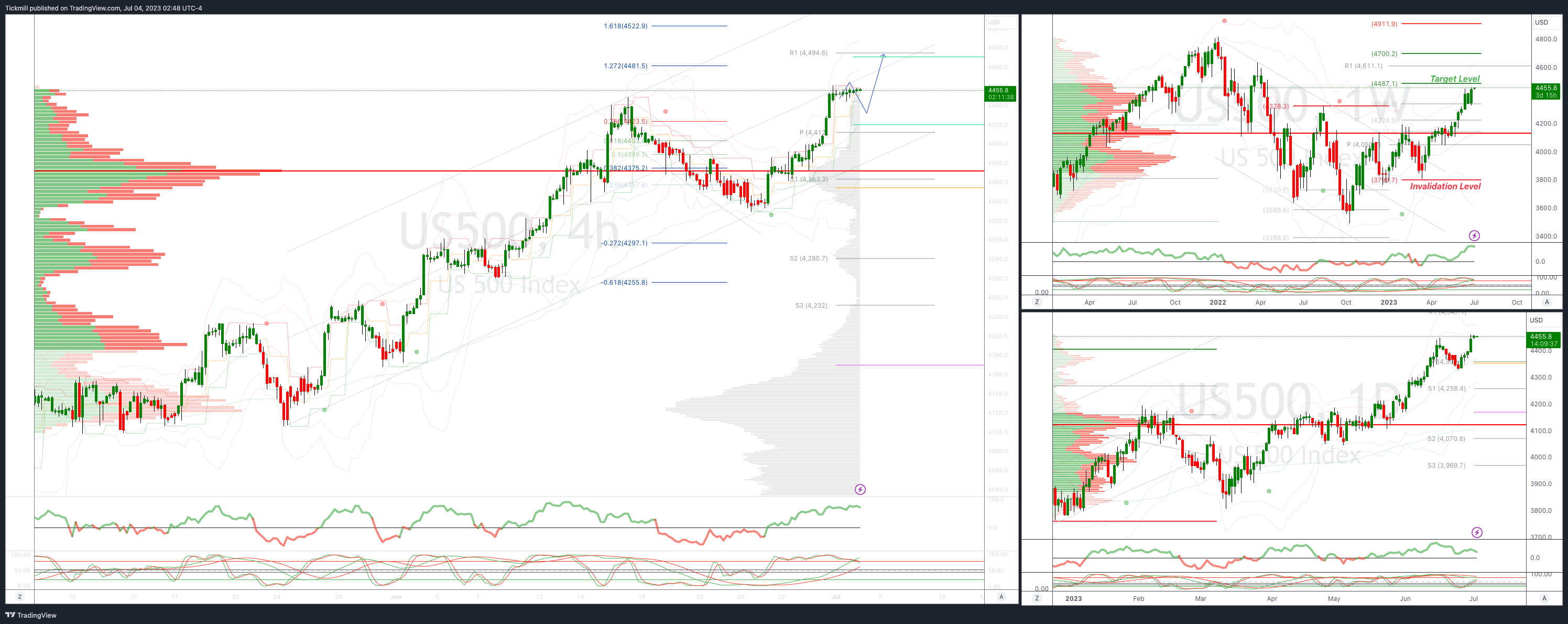

SP500 Bias: Intraday Bullish Above Bearish Below 4412

Below 4400 opens 4370

Primary support is 4300

Primary objective is 4580

20 Day VWAP bullish, 5 Day VWAP bullish

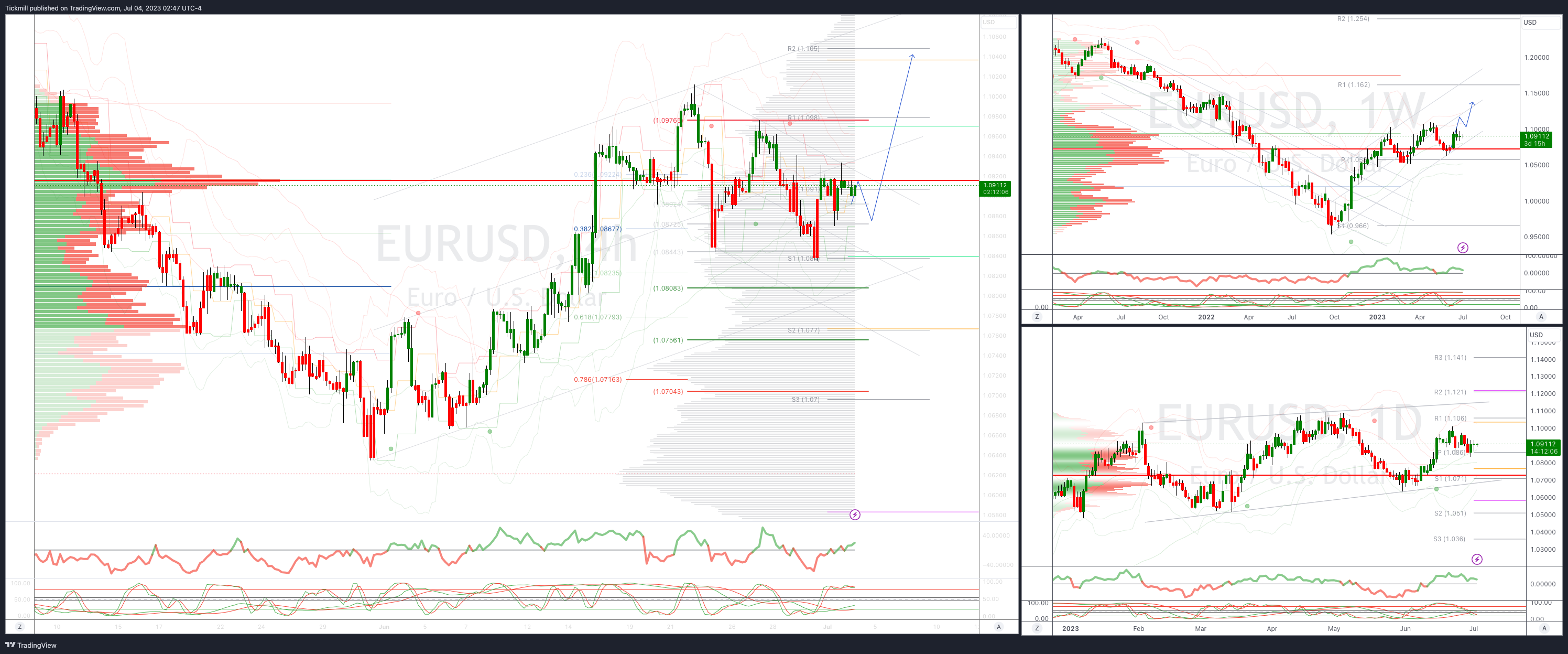

EURUSD Intraday Bullish Above Bearsih Below 1.0840

Below 1.0840 opens 1.08

Primary support is 1.0666

Primary objective is 1.1050

20 Day VWAP bullish, 5 Day VWAP bullish

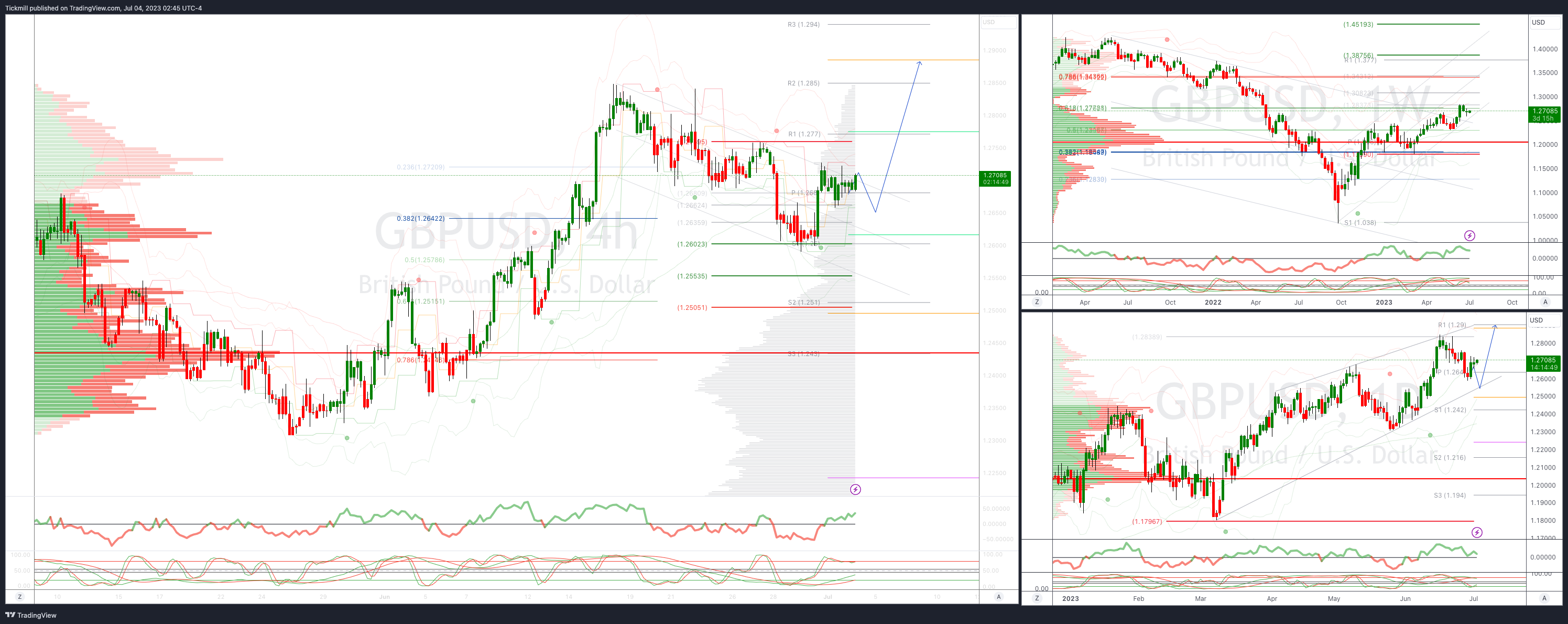

GBPUSD Bias: Intraday Bullish Above Bearish Below 1.2650

Below 1.26 opens 1.2550

Primary support is 1.2680

Primary objective 1.2880

20 Day VWAP bullish, 5 Day VWAP bullish

USDJPY Bullish Above Bearish Below 143.50

Below 143 opens 142.30

Primary support is 141

Primary objective is 145.50

20 Day VWAP bullish, 5 Day VWAP bullish

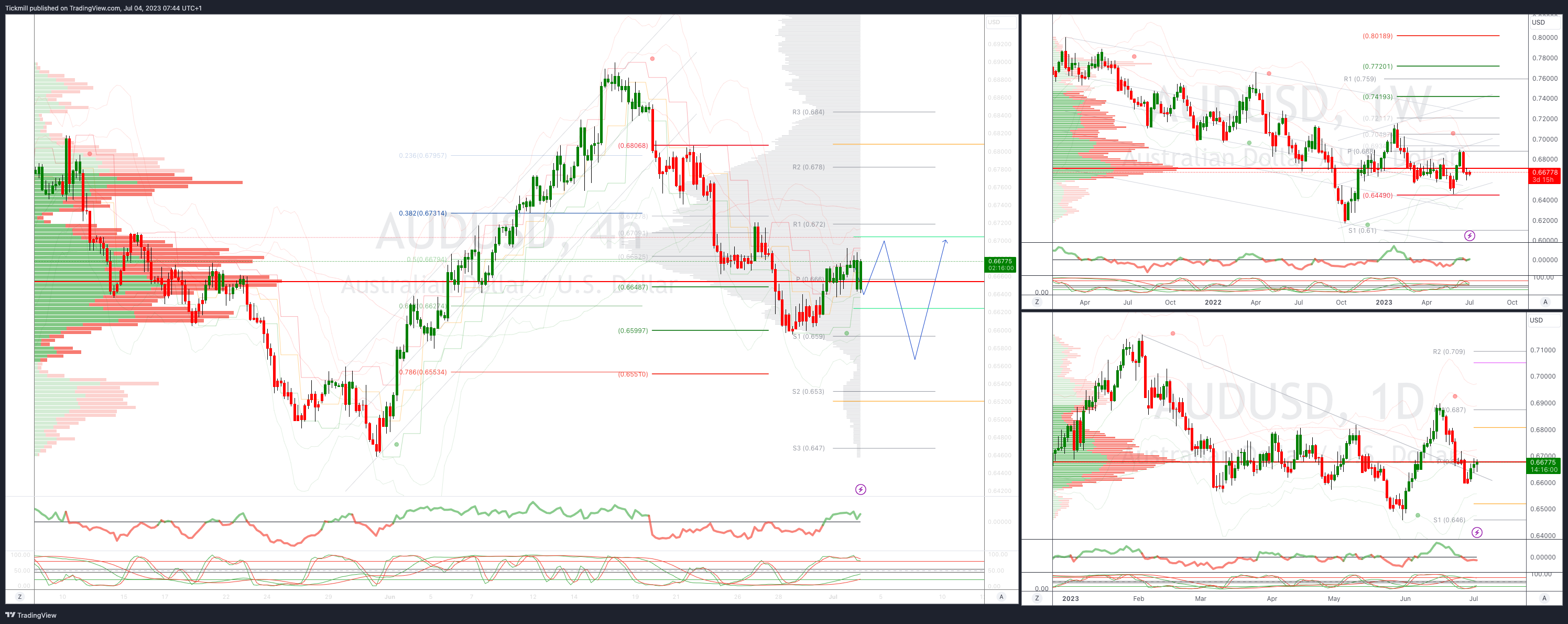

AUDUSD Bias:Intraday Bullish Above Bearish Below .6660

Below .6600 opens .6550

Primary support is .6448

Primary objective is .6917

20 Day VWAP bearish, 5 Day VWAP bullish

BTCUSD Intraday Bullish Above Bearish below 30000

Below 29400 opens 28600

Primary support is 28400

Primary objective is 32750

20 Day VWAP bullish, 5 Day VWAP bullish

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

Patrick has been involved in the financial markets for well over a decade as a self-educated professional trader and money manager. Flitting between the roles of market commentator, analyst and mentor, Patrick has improved the technical skills and psychological stance of literally hundreds of traders – coaching them to become savvy market operators!