Daily Market Outlook, February 5, 2024

Daily Market Outlook, February 5, 2024

Munnelly’s Market Minute…“Powell Hitting Pause On Rate Cut Expectations”

Asian stocks were mostly subdued due to the red-hot jobs report and Fed Chair Powell's comments indicating a likely delay in a March rate cut. In a pre-recorded TV interview aired last night, US Fed Chair Powell reiterated that more progress on inflation’s final descent was needed before the central bank would cut rates, aligning with comments made at last week’s policy meeting press conference. Powell also indicated that the scale of cuts priced in by financial markets seemed excessive relative to the Fed’s own expectations, while suggesting that the first cut would not occur until the middle of the year. The Nikkei 225 was supported by recent currency weakness, with earnings influencing the biggest movers. Hang Seng and Shanghai Comp initially faced pressure from a continuation of the equity rout, but Chinese markets later recovered from their lows.

In the UK the Office for National Statistics (ONS) published revised UK labor market data, adjusted for new population estimates. Notably, the latest read on the UK unemployment rate, covering the three months to November, was reported to be 3.9% compared with a previous estimate of 4.2%, indicating that the labor market was tighter than previously assumed.

Looking ahead, there was minimal chance that the US and UK central banks would change interest rates at their policy updates last week. Both the Federal Reserve and the Bank of England maintained interest rates at the 5.25-5.50% range and 5.25%, respectively. Financial markets, however, focused on signals about the timing and extent of potential interest rate reductions this year.

This week, the UK and US inflation prints for January are due. Meanwhile, key survey data this week will provide insight into evolving price pressures and wider economic trends. In particular, today’s US ISM services survey is expected to rise to 52.5 from 50.5, indicating positive growth in service sector activity. In Europe, the final estimates of the UK and Eurozone services PMI for January are expected to be unrevised. Questions remain about the PMI survey's accuracy in predicting actual GDP growth. However, the UK services survey has signaled growth for a third consecutive month, while the Eurozone picture still reflects contraction, albeit with increasing optimism for future prospects.

Stateside focus will be on speeches by Fed officials Raphael Bostic, Loretta Mester, and Thomas Barkin for clues on the timing of rate cuts after last week's policy meeting and Friday's strong U.S. employment numbers, which may impact the central bank's confidence in inflation.

Overnight, the Reserve Bank of Australia is expected to leave interest rates unchanged at 4.35%. Markets will observe if it adjusts its hawkish bias following recent softer data. In the UK, the British Retail Consortium (BRC) releases its January update of retail sales.

Overnight Newswire Updates of Note

Jay Powell Says Fed Expects To Make Three Rate Cuts This Year

US Yields Jump As Powell And Payrolls Drive Selling

China Securities Regulator Vows To Prevent The Risk From Pledged Stocks

Australia Goods Trade Surplus Narrows To AUD10.9 Bln In Dec

ECB’s Vujcic Says Patience Needed Before Starting Rate Cuts

German Top Ministers Weigh Corporate Tax Reform

US Says Strikes Against Iran-Backed Militias Are ‘Beginning, Not The End’

Hamas Denies Rejection Of Hostage, Ceasefire Deal, To Deliver Answer Soon

Oil Edges Higher As US Attacks On Houthis Ratchet Up Tensions

China Stocks Languish Despite Renewed Vow To Stabilize Markets

Foxconn Sees 'Slightly Better' 2024, Warns On AI Chip Shortage

Boeing Finds New Problem With 737 MAX Fuselages

(Sourced from Bloomberg, Reuters and other reliable financial news outlets)

FX Options Expiries For 10am New York Cut

(1BLN+ represent larger expiries, more magnetic when trading within daily ATR)

EUR/USD: 1.0780 (230M), 1.0800 (314M), 1.0870 (554M)

GBP/USD: 1.2600 (260M), 1.2645-50 (935M)

NZD/USD: 0.6060 (610M), 0.6100 (450M)

USD/JPY: 148.00 (1.1BLN)

CFTC Data As Of 2/02/24

USD bearish neutral -5,618

CAD neutral neutral -178

EUR bullish neutral 12,034

GBP bullish neutral 2,711 218

AUD bearish increasing -3,849

NZD neutral neutral -64

MXN bullish neutral 2,343

CHF bearish neutral -566

JPY bearish increasing -6,813

Technical & Trade Views

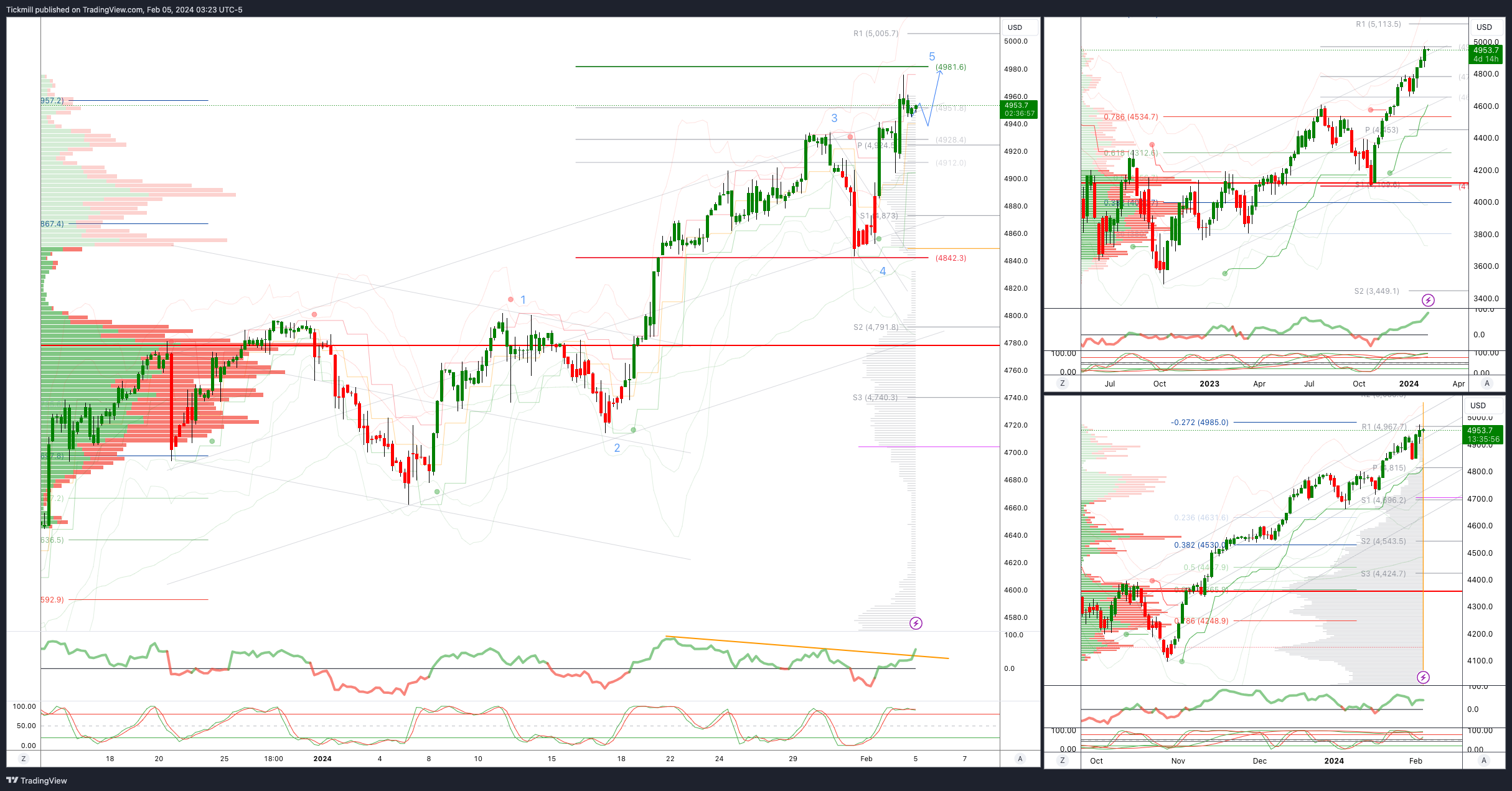

SP500 Bullish Above Bearish Below 4940

Daily VWAP bullish

Weekly VWAP bullish

Below 4900 opens 4800

Primary support 4800

Primary objective is 4981

EURUSD Bullish Above Bearish Below 1.0875

Daily VWAP bearish

Weekly VWAP bearish

Above 1.10950 opens 1.10

Primary resistance 1.10

Primary objective is 1.0730

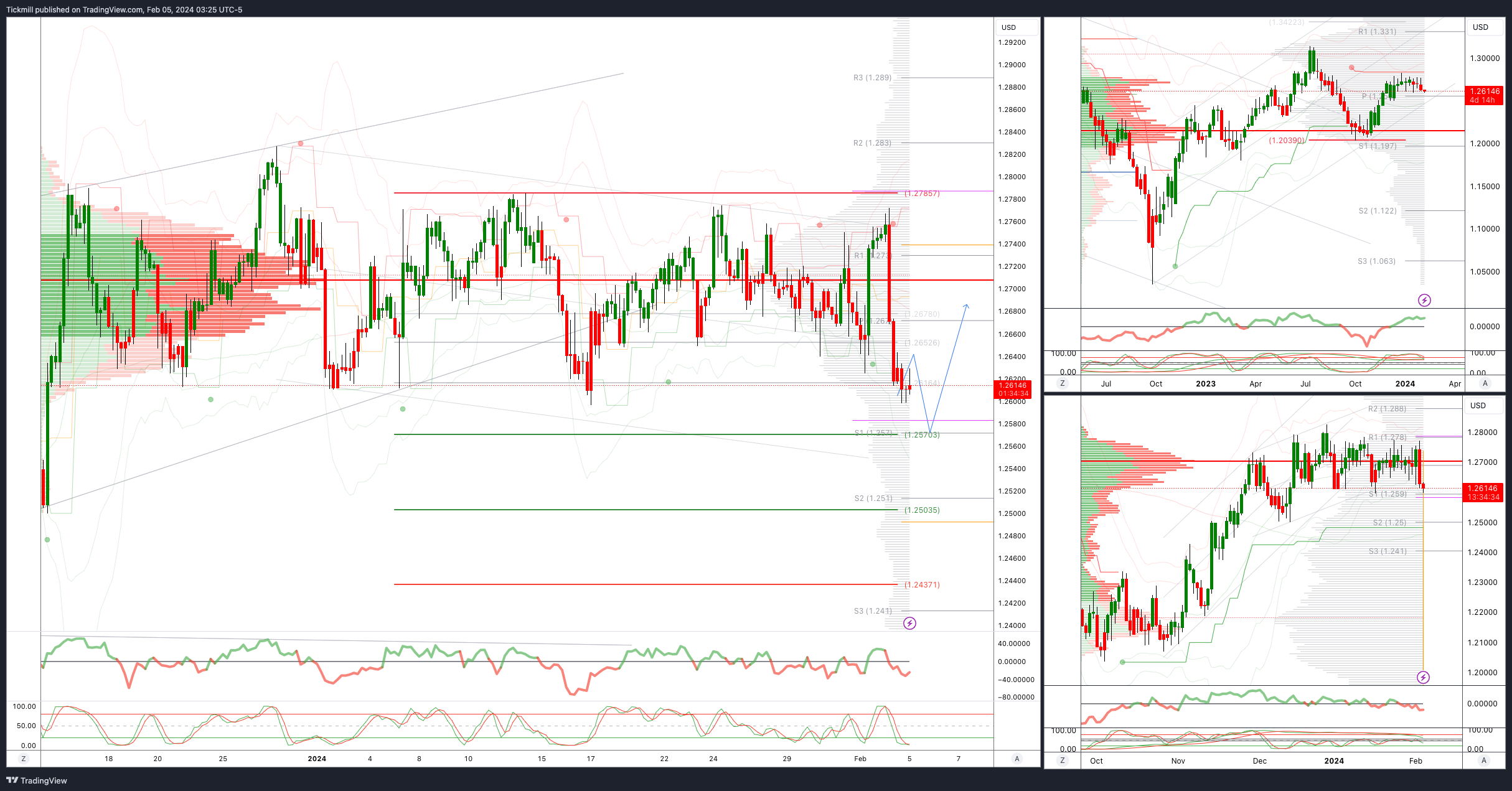

GBPUSD Bullish Above Bearish Below 1.2750

Daily VWAP bearish

Weekly VWAP bearish

Above 1.28 opens 1.2870

Primary resistance is 1.2785

Primary objective 1.2570

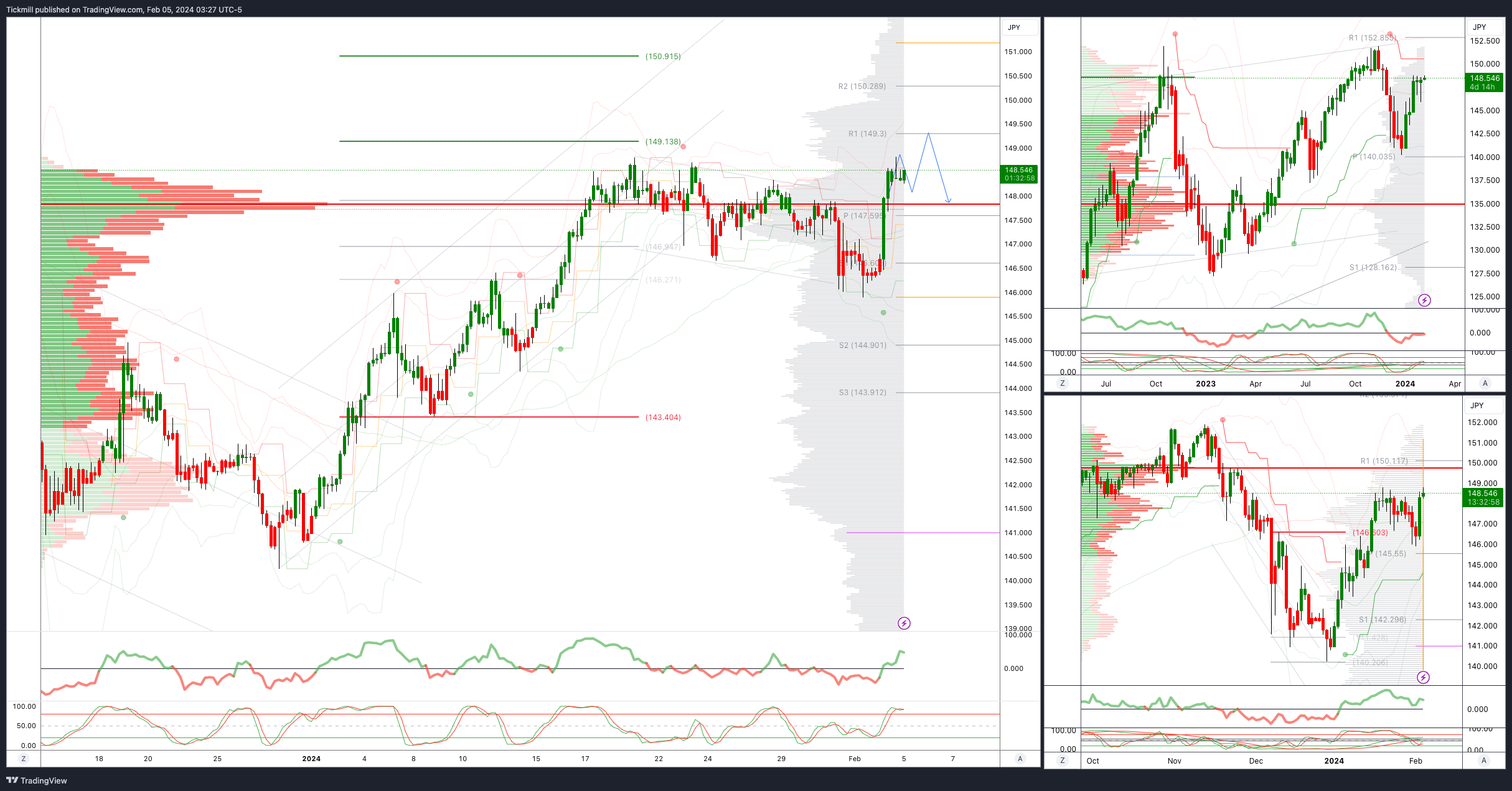

USDJPY Bullish Above Bearish Below 147.50

Daily VWAP bullish

Weekly VWAP bullish

Below 146 opens 145.50

Primary support 143.50

Primary objective is 149.13

AUDUSD Bullish Above Bearish Below .6650

Daily VWAP bearish

Weekly VWAP bearish

Below .6500 opens .6420

Primary support .6525

Primary objective is .6260

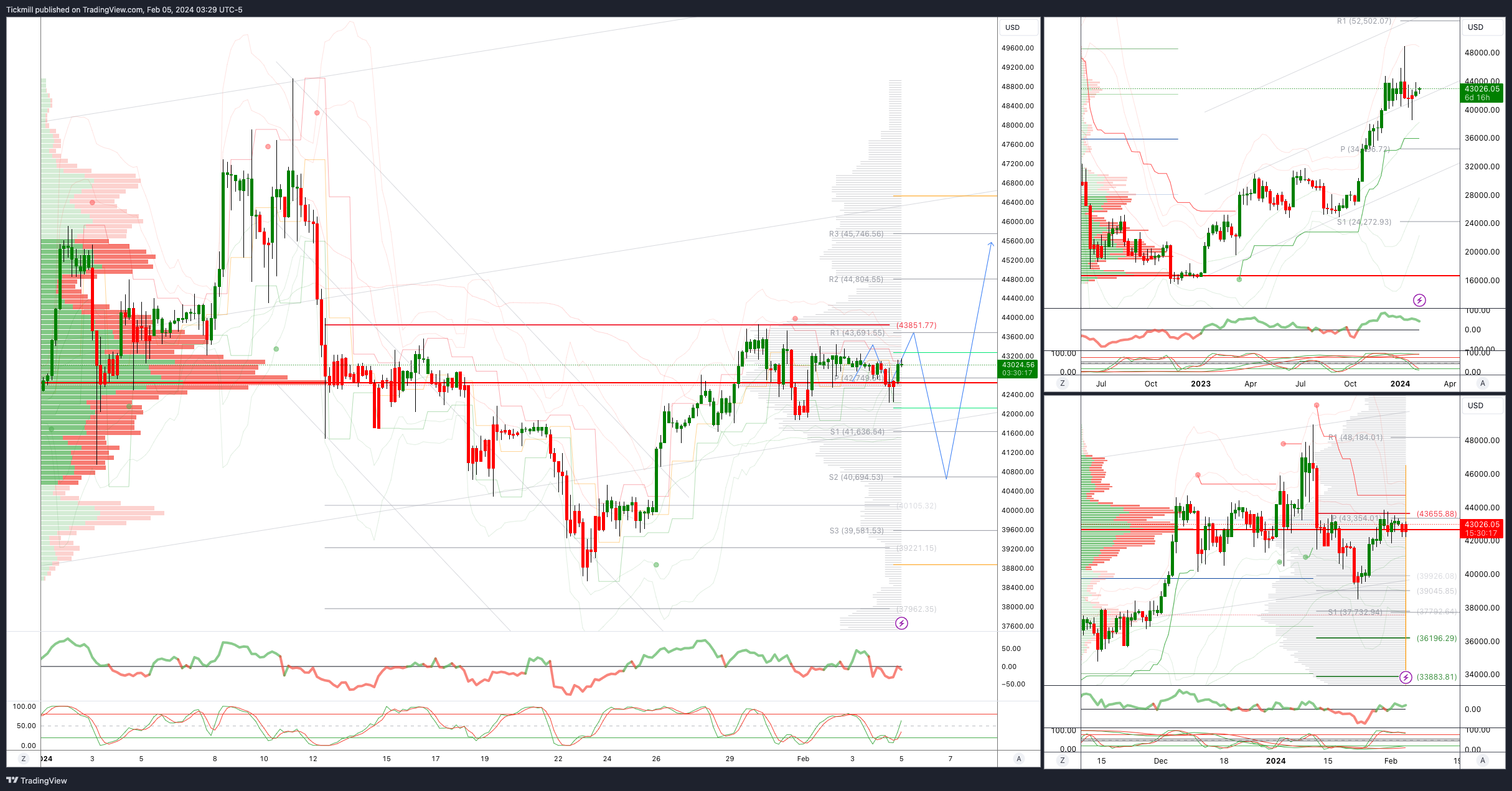

BTCUSD Bullish Above Bearish below 43850

Daily VWAP bullish

Weekly VWAP bullish

Above 43600 opens 44700

Primary resistance is 44700

Primary objective is 44700

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

Patrick has been involved in the financial markets for well over a decade as a self-educated professional trader and money manager. Flitting between the roles of market commentator, analyst and mentor, Patrick has improved the technical skills and psychological stance of literally hundreds of traders – coaching them to become savvy market operators!