Daily Market Outlook, August 25, 2020

Daily Market Outlook, August 25, 2020

Asian equity market is mostly higher after gains yesterday in Europe and the US, but Chinese indices are modestly lower. US and Chinese policymakers gave a positive verdict after their first assessment of the impact of last year’s trade deal. However, President Trump subsequently said that he was willing to “decouple” from China if “they don’t treat us right”. Meanwhile, US new coronavirus cases were reported to have fallen for a fifth week in a row.

The final reading of Q2 German GDP saw a modest upward revision to -9.7% (from 10.1% previously). Norwegian GDP was estimated to have fallen by 6.3% in Q2.

After Friday’s disappointing Eurozone PMI data today’s August German IFO survey will be watched closely. The slowdown in the PMIs was primarily concentrated in services. In contrast, the manufacturing measure for the region was down only modestly from July, and in the case of Germany was up. The fall seems too early to be a response to the rise in Covid-19 cases in recent weeks. However, it may be a sign that the initial post-lockdown surge in activity has begun to run its course amidst a number of underlying impediments to growth. For today’s IFO look for a modest increase in the headline index, reflecting a further rise in current conditions but a small fall in the expectations index. The PMI reports point to downside risks to the forecast, but the two do not always move in tandem in the near-term.

Official data for UK July retail sales surprised significantly on the upside, casting doubt on anecdotal reports that sales have slowed sharply after an initial burst of post-lockdown pent up demand. Today’s CBI retail survey provides the first indications of how things have gone in August, with consumers having a greater number of alternatives of where and how to spend their money as more consumer services venues emerged from lockdown.

In the US, there are a number of indicators scheduled that will provide further clues to whether the economy is continuing to strengthen. Housing activity seems buoyant for now and data releases last week for both housing starts and existing home sales showed very strong rises in July. Today’s new home sales release is expected to show a slower pace of growth but that follows a very strong gain in June.

Two timely indications in August will be provided by the Conference Board’s consumer confidence measure and the Richmond Fed’s manufacturing index. A modest rise is forecast for consumer confidence as other previously released measures have suggested on the month. However, the outlook for the Richmond Fed’s survey looks less positive considering that its equivalents in New York and Philadelphia surprised significantly on the downside.

CITI: Month-End FX Hedge Rebalancing: August 2020 Preliminary Estimate

The preliminary estimate of month-end FX hedge rebalancing flows points to a net USD selling need on Monday, 31 August. Good performance of Japanese assets means that the sell USDJPY signal is amongst the weakest this month. The signal to buy GBPUSD is strongest at 0.96 historic std. dev, although below the 1 std. dev threshold that we consider significant.The FX impact suggests USD selling against EUR and GBP at month end.

Today’s Options Expiries for 10AM New York Cut (notable size in bold)

- EURUSD: 1.1770 (256M), 1.1800 (607M), 1.1825 (266M), 1.1850 (1BLN)

- USDJPY: 105.25-30 (1.6BLN), 105.50 (253M), 105.75 (220M), 106.10 (250M)

- GBPUSD: 1.3000 (314M)

Technical & Trade Views

EURUSD Bias: Bullish above 1.17 targeting 1.20

EURUSD From a technical and trading perspective, the breach of trendline support and suggests that we may be entering an extended consolidation phase, as 1.1860/80 contains upside attempts look for a retest of 1.17 base before another attempt to test the psychological 1.20

GBPUSD Bias: Bullish above 1.32 Bearish below targeting 1.30

GBPUSD From a technical and trading perspective, erratic price action into the end of last week, printing three daily reversal patterns, Friday’s bearish reversal on the Daily time frame flipped the daily chart bearish again, as 1.32 now acts as resistance look for a test of range support to 1.30

USDJPY Bias: Bullish above 105.50 Bearish below

USDJPY From a technical and trading perspective, as 106.50 acts as resistance look for another test of support at 105.50 failure to find sufficient bids here will expose 104.18 again. Note DTCC shows a massive USD 7-billion 105.00 strike option expiries this week. Biggest collection Wednesday - USD 3.2-billion, and Thursday - 1.6-billion. Several billion Wed-Thurs from 105.75 to 105.40 too, but little above 106.00

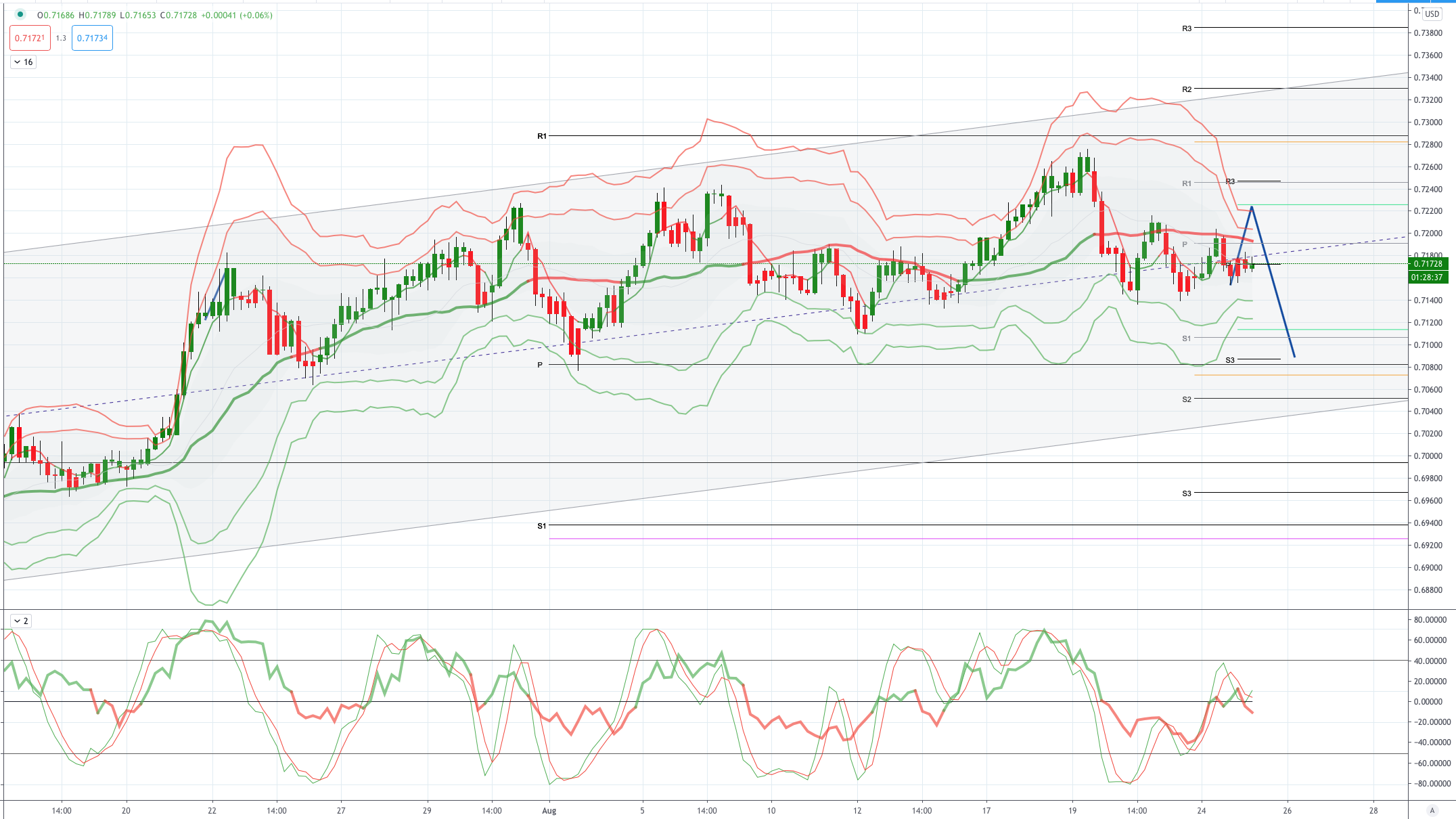

AUDUSD Bias: Bullish above .7200 Bearish below

AUDUSD From a technical and trading perspective, reversal from the test of offers above .7250 finds support at .7150 as this contains the downside look for another run at .7300 before a more meaningful reversal UPDATE a closing breach of .7140 would delay the upside objectives suggesting a test of base support back to .7080

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 73% and 76% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

Patrick has been involved in the financial markets for well over a decade as a self-educated professional trader and money manager. Flitting between the roles of market commentator, analyst and mentor, Patrick has improved the technical skills and psychological stance of literally hundreds of traders – coaching them to become savvy market operators!