Crude Risks Grow Around Russia/Ukraine Escalation

Geopolitical Risks Driving Crude

Crude oil prices are looking a little softer at the start of the week, with the futures market in the red through early European trading on Monday. Last week, prices were seen rallying sharply as traders reacted to news of a worrying intensification of the Russia/Ukraine war. Ukraine’s use of US and UK missiles against Russia and Russia subsequent threat of a nuclear retaliation, and use of an ICBM against Ukraine, present a concerning escalation of the conflict. Growing fears of damage to energy infrastructure and consequent supply disruption are likely to keep oil prices underpinned near-term, limiting the current pullback.

Russia/Ukraine

Traders will be monitoring incoming headlines regarding the war this week. Any further worrying rhetoric from Russia or an escalation from either side, is likely to see oil prices spike higher. Russia has recently lowered the barrier for use of nuclear arms and the firing of an ICBM last week means that the West can no longer afford to think Putin is bluffing.

Fed and USD

Alongside this, traders will also be keeping an eye on USD flows. Traders have scaled back their Fed easing expectations recently with projections for a December cut now roughly around the 50% market from above 80% a month ago. Incoming US data this week and the FOMC minutes will be closely watched. Any fresh USD upside is likely to have a dampening effect on oil prices. However, given the level of uncertainty around geo-political risks, USD is unlikely to be the main driver for oil unless see any significant surprises this week.

Technical Views

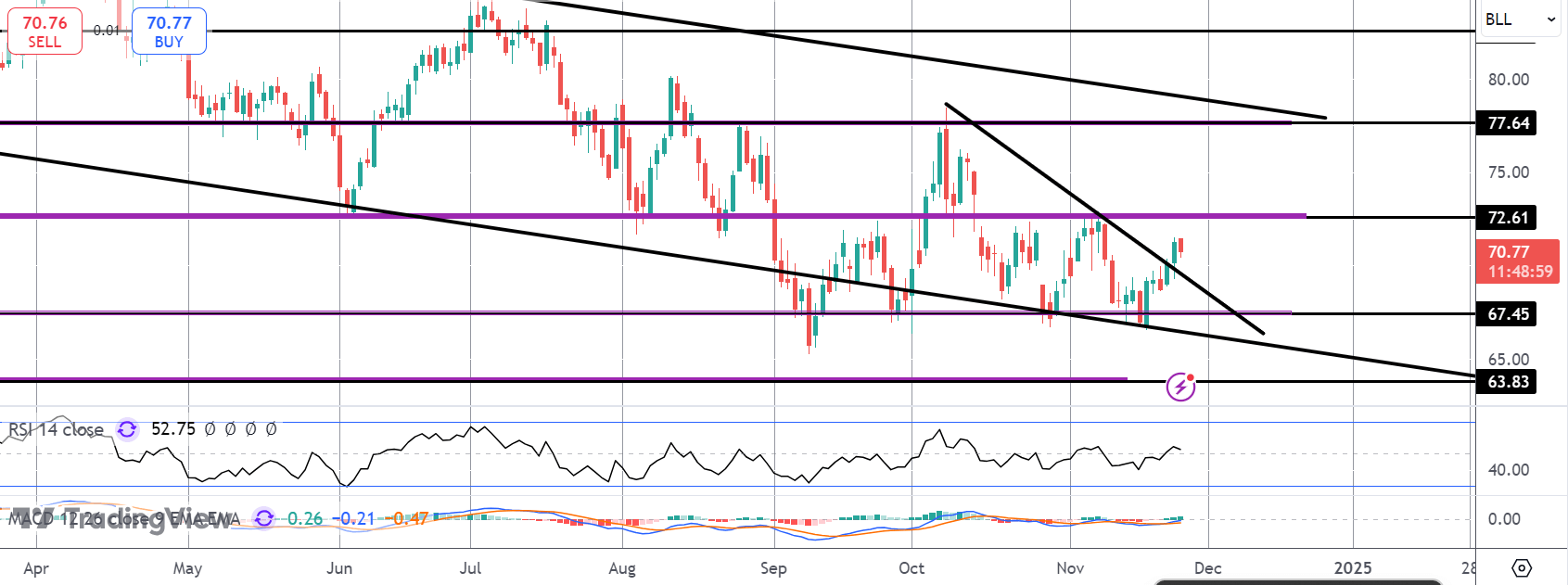

Crude

The rally last week saw the market breaking above the contracting triangle pattern, suggesting room for a fresh push higher. 72.61 will now be the key focus point for bulls, with a break there opening the way for a run up to 77.64 next.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

With 10 years of experience as a private trader and professional market analyst under his belt, James has carved out an impressive industry reputation. Able to both dissect and explain the key fundamental developments in the market, he communicates their importance and relevance in a succinct and straight forward manner.