Covid-19 is Back in the News and in the Markets

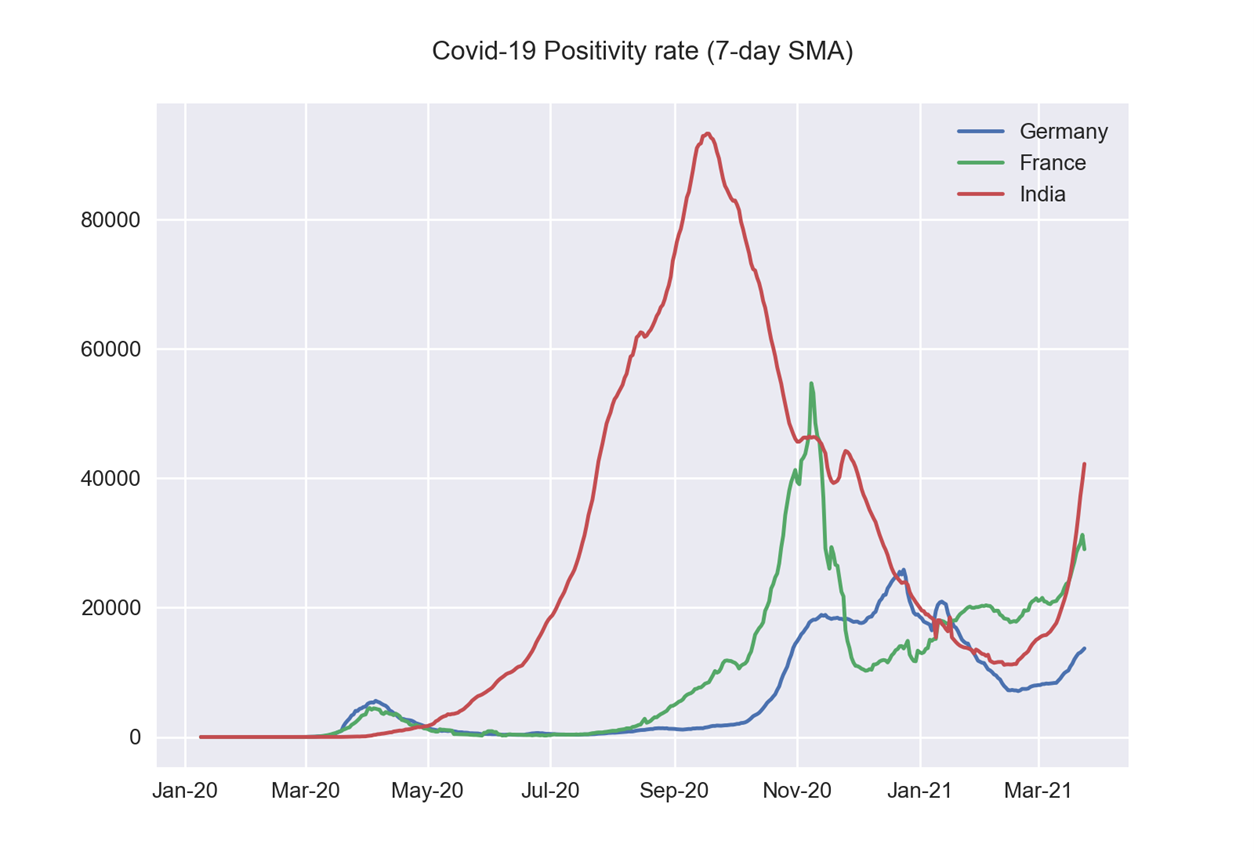

US indices closed in the red on Wednesday and oil went down again as concerns about the third wave of coronavirus and mutations intensified due to increasing positivity rates around the world. The daily growth of new confirmed cases in Germany, France and India has reached the highest pace in several months:

In a number of other countries, record levels of daily growth of new cases have been recorded, which made investors reluctant to face up to a possible downside in risk assets.

Doubts about the effectiveness of vaccines against new strains and vaccine supply bottlenecks further worsened the outlook for the third wave, increasing risk aversion in the markets.

The demand for long-term bonds of developed countries increased, which is evident from the fact that their yields drifted lower. Another rebound in oil after two large collapses did not last long, today the quotes are in the red again. European equities are moderately negative, futures for US indices rebounded on Thursday after moderate pessimism dominated the American session on Thursday.

Comments from a number of Fed officials yesterday were mixed, although Powell again focused on a weak labor market and the need to achieve full employment. The data on the American economy came out worse than expected, the orders for durable goods (an important component of consumer spending) didn’t live up to market expectations. Jobless claims today should provide more insight into how much recovery momentum faded in the US economy in a weak second month.

EURUSD is moving towards the target level of 1.1750, which corresponds to the lower bound of the current descending channel and is likely to touch it by the end of the month:

GBPUSD is also in the downtrend and after breaking the steep upward channel since October last year, the next target is the uptrend line at 1.35500:

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 75% and 65% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 73% and 72% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.