Chart of The Day US500 (S&P500)

Chart of the Day US500 (S&P500)

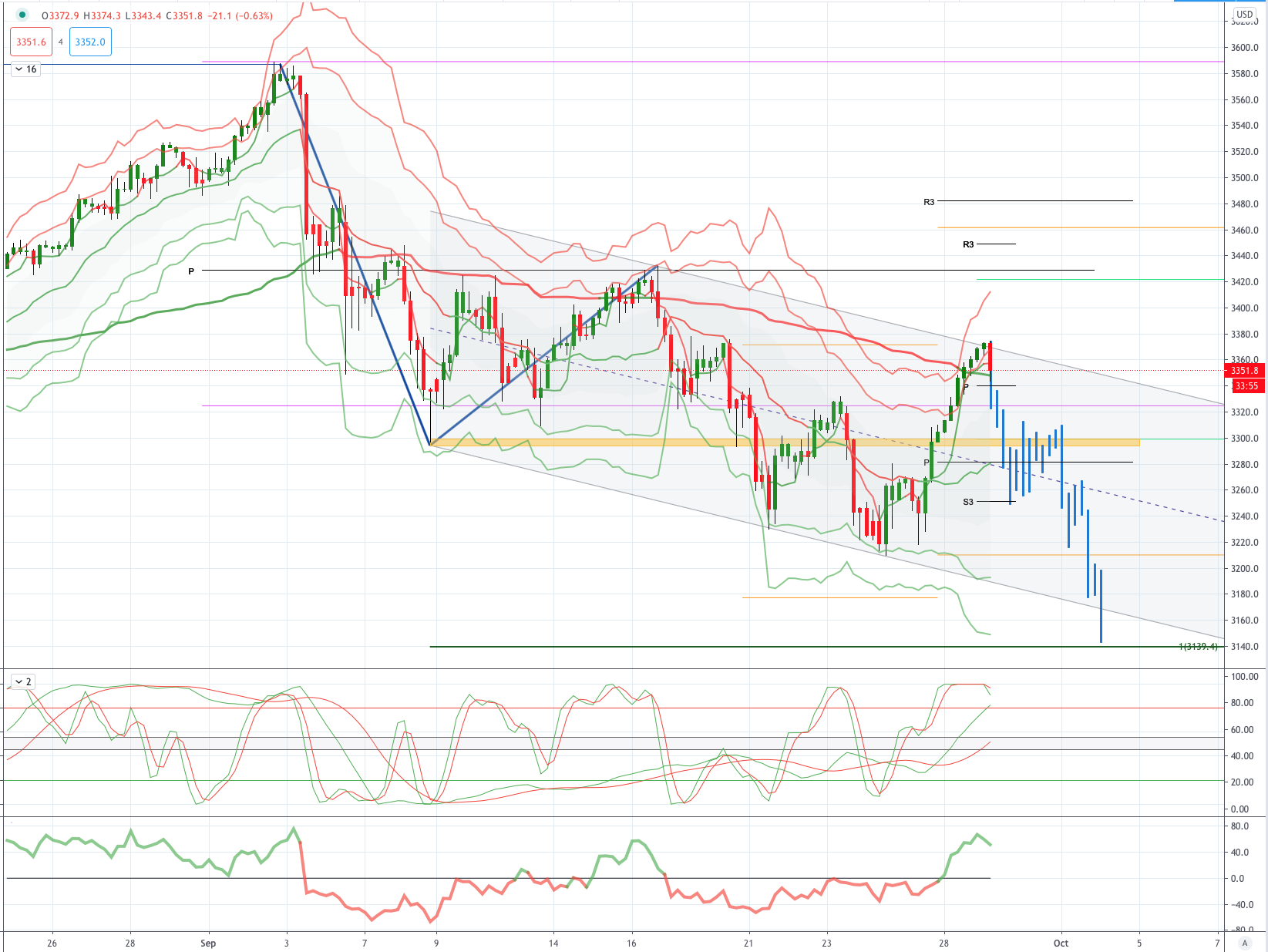

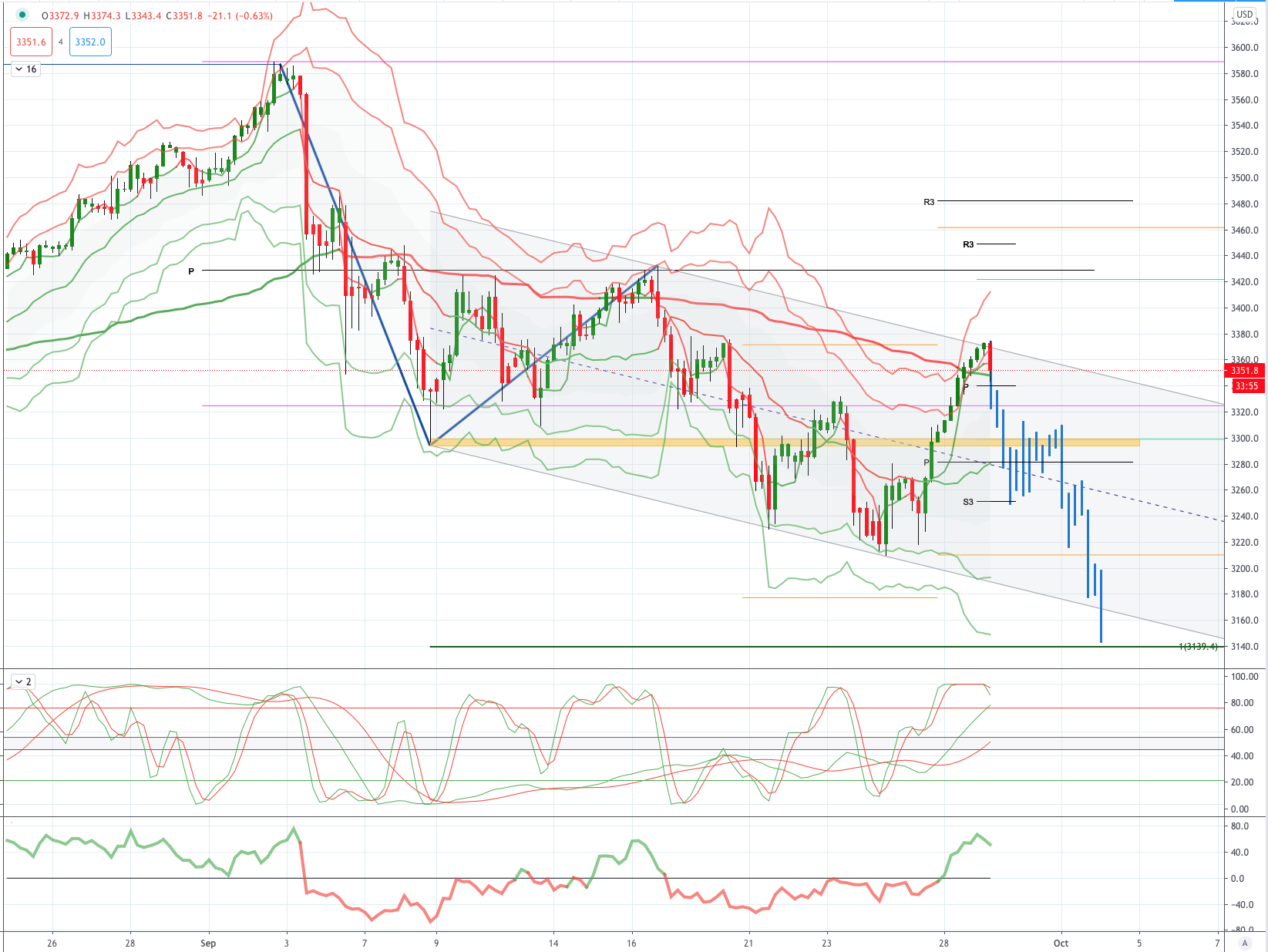

US500 (S&P500) Potential Reversal Zone - Probable Price Path

ROUND 1 OF US PRESIDENTIAL DEBATES

The first of the US presidential debates will be held on Tuesday night at 9pmET. The next debate will be on October 15th and then the final one will be held on October 22nd with the VP candidates duking it out on October 7th.

Do these debates matter to markets and to the eventual election outcome? The answer is that usually they do not, but on occasion they can matter. Chart 1 shows what happened to the ultimate victor’s polling between just before the first debate and when the final election results became known. Remember 2000? Gore had better command of the issues, but perhaps lost it on the charm factor and so his strong lead was ultimately blown. The elections of 1992, 1996, 2004, 2008 and 2012 were not really changed by the debates or other influences through the intervening period. The election in 2016 would see Trump go on to a materially higher share of the popular vote than his pre-debate polling indicated, even though he failed to get over 50% as was the case in the 1992, 1996 and 2000 elections.

Note the parallel to 2016. Hillary Clinton went in with a six percentage point lead in the polls according to the NBC/WSJ poll ahead of the first debate and ultimately garnered 48.2% of the vote on election day for a final 2.1 point greater share over Trump who won the election in the Electoral College. Trump’s improvement in was among the biggest in the past three decades. Today, Biden holds an eight percentage point lead in the NBC poll over Trump.

From a technical and trading perspective, the S&P500 is sitting at projected trend channel resistance. On the intraday time frame (H4) bears will be looking for a close sub 3340 to encourage bearish exposure targeting the daily equality objective sighted at 3139. Enroute to the primary downside objective 3300 is likely to be pivotal as this area has the potential to act as support for an inverse head and shoulders scenario to develop, it also represents predicted daily range support, if bids can be eroded here then through the weekly pivot at 3280 should encourage sufficient downside pressure to challenge prior cycle lows at 3208 ahead of the primary objective at 3139

Disclaimer: The material provided is for information purposes only and should not be

considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 73% and 76% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

Patrick has been involved in the financial markets for well over a decade as a self-educated professional trader and money manager. Flitting between the roles of market commentator, analyst and mentor, Patrick has improved the technical skills and psychological stance of literally hundreds of traders – coaching them to become savvy market operators!