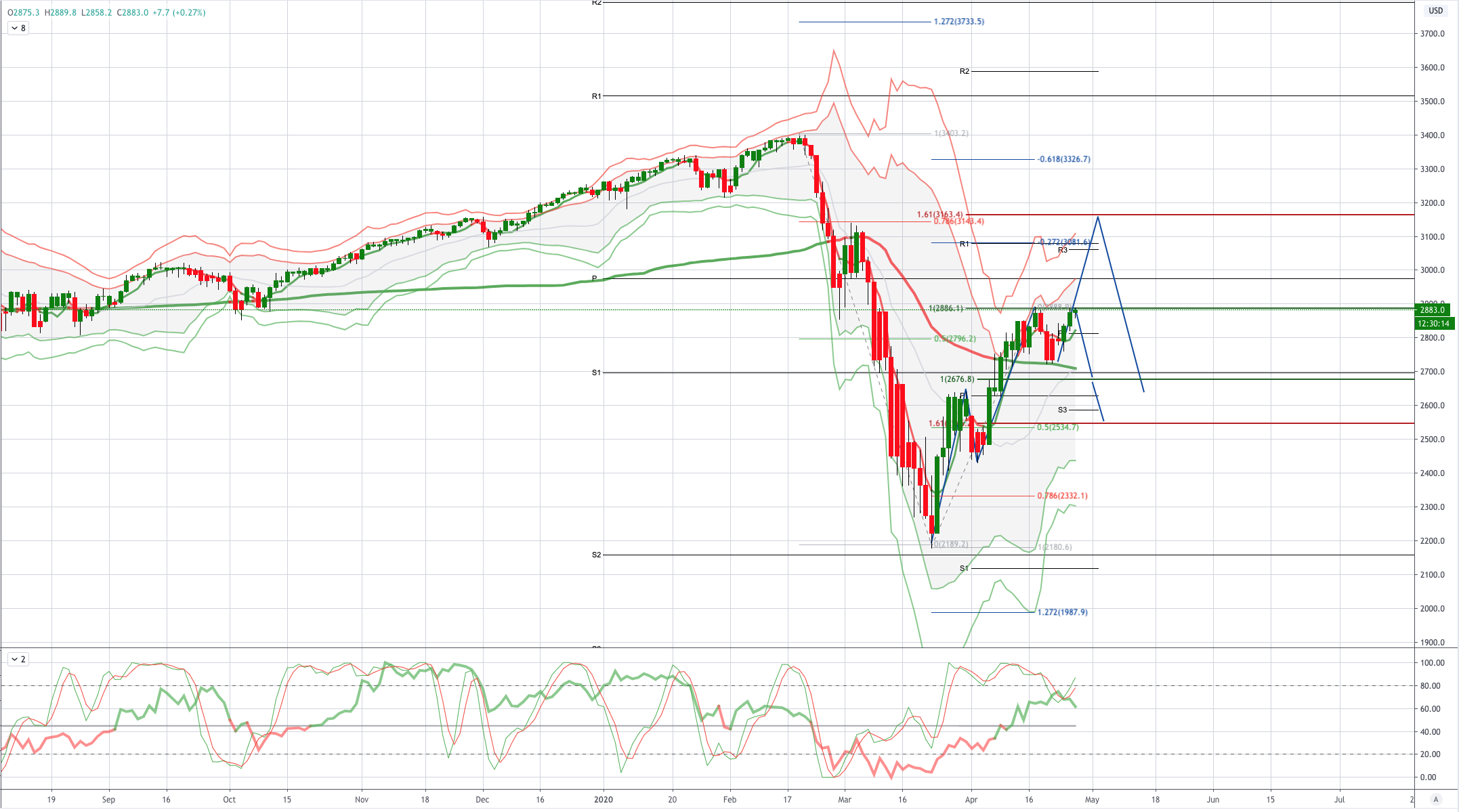

Chart of the Day US500 (S&P500)

US500 (S&P500) - Probable Price Path

Global risk appetite improved yesterday with the S&P500 gains exceeding 1% amid hopes of economies reopening as infections flatten for the US and Italy in particular. This was notwithstanding global Covid-19 infections crossing 3 million. Crude oil prices tumbled again with WTI down 25% to $12.93 per barrel as the US oil fund USO shifted out from the June contract to July 2020-June 2021. The S&P500 added 1.5% to hit a six week high, with VIX down to 33.29 while UST bonds bear-steepened with the 10- year bond yield at 0.66%. The 3-month LIBOR eased again to 0.84075% while LIBOR-OIS narrowed to 77bps. Meanwhile, BOJ lifted the JPY80t cap on its bond-buying program yesterday as widely anticipated, with Governor Kuroda opining that their scale of easing is “far larger” than any other central bank. Elsewhere, EU members may be allowed to grant subordinated debt to companies on favourable terms in an amendment of state aid rules and relief on how banks calculate the leverage ratio may also be forthcoming. After the sizeable gains in many equity markets yesterday the market tone this morning is more cautious. Asian stock market performance has been mixed today with most moves only modest

The Fed is expanding the scope and duration of its $500b Municipal Liquidity Facility by lowering the population thresholds. Meanwhile, US states including Texas, Florida and Ohio are moving towards easing restrictions, while the Trump administration is expanding US testing to 2% of the public by partnering with retail companies and pharmacies. Spain and France are also moving towards loosening containment measures. In the UK PM Johnson has returned to work but warned against lifting the lockdown prematurely.

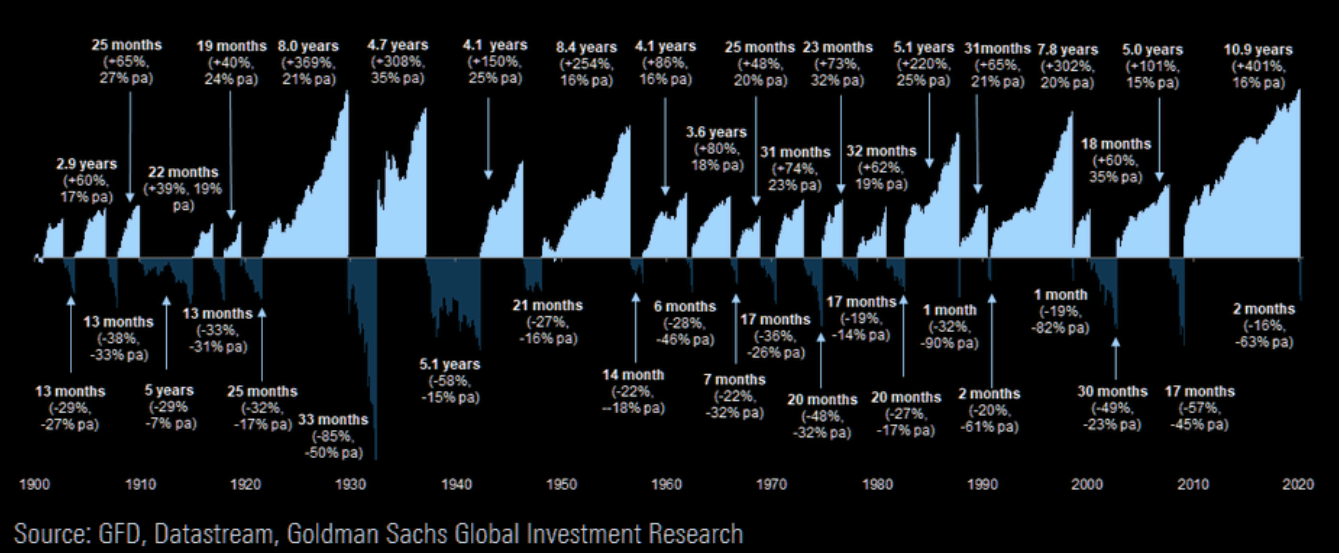

From a technical and trading perspective, the US500 is re-testing the primary equality objective at 2886a close back below the near term volume weighted average price sighted at 2810 would suggest a local corrective high is in place and bearish exposure sub 2800 should be rewarded at least for a test of symmetry swing support back towards 2676. A failure to find sufficient bids here would open a move to the next support cluster at 2535. A close today above the prior cycle highs will open a move to test the next resistance cluster at 3143 representing the 78.6% retracement and the 1.61 extension measured from the early April higher low. This will be a pivotal test as if we clear this area, the prior all time high becomes the next upside objective threatening the potential for a new bull market. Anecdotally Goldman Sachs research note that if this was to be the case it would represent a historically short and mild downturn relative to the severity of the collapse

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 73% and 70% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 73% and 72% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

Patrick has been involved in the financial markets for well over a decade as a self-educated professional trader and money manager. Flitting between the roles of market commentator, analyst and mentor, Patrick has improved the technical skills and psychological stance of literally hundreds of traders – coaching them to become savvy market operators!