Can Copper Bounce Back?

Copper Escapes Tariffs… For Now

Copper prices are seeing plenty of volatility today on the back of Trump’s so-called tariff ‘Liberation Day’ yesterday. The red metal plunged lower initially, with the futures price dropping around 4% from yesterday’s close before buyer stepped in into the lows. Price is now fighting to recover those losses, likely helped in part by a heavy sell off in the US Dollar. Alongside the sell-off in USD, copper prices are also being buoyed by the fact that the metal was spared its own import duty. Trump had threatened a copper specific tariff though this was left out of the measures announced yesterday. Indeed, while copper prices have fallen amidst a downturn in risk assets amidst weaker global growth expectations, we might yet see a rebound for copper.

Global Growth Fears

Supply issues have been a big driver of the rally recently and with these issues unlikely to be resolved near-term, the market should remain underpinned. The question now is how much US and Chinese demand will suffer as a result of the fresh tariffs announced yesterday. If global growth turns lower as forecasted, this could cap any rally in copper. With that in mind, traders will be looking at tomorrow’s incoming US jobs data. Should we see further weakness, on the back of the prior month’s soft data, this could spell further trouble for copper near-term as US recession fears take centre stage again.

Technical Views

Copper

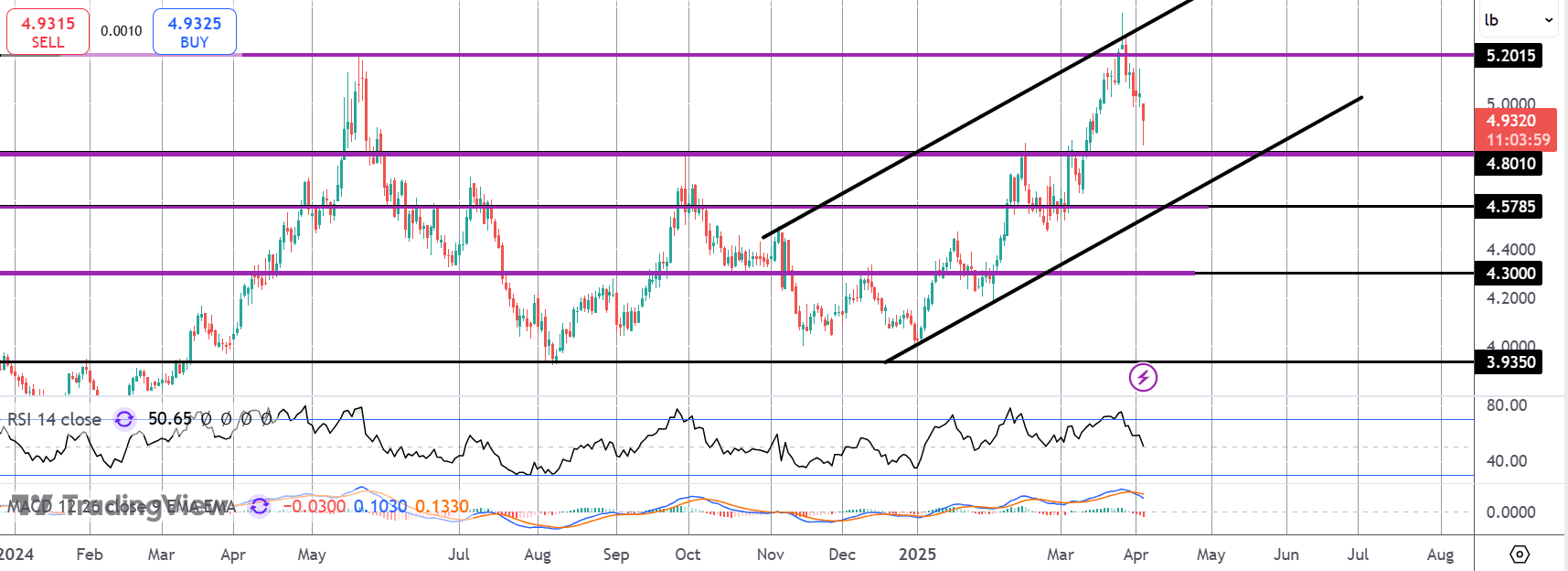

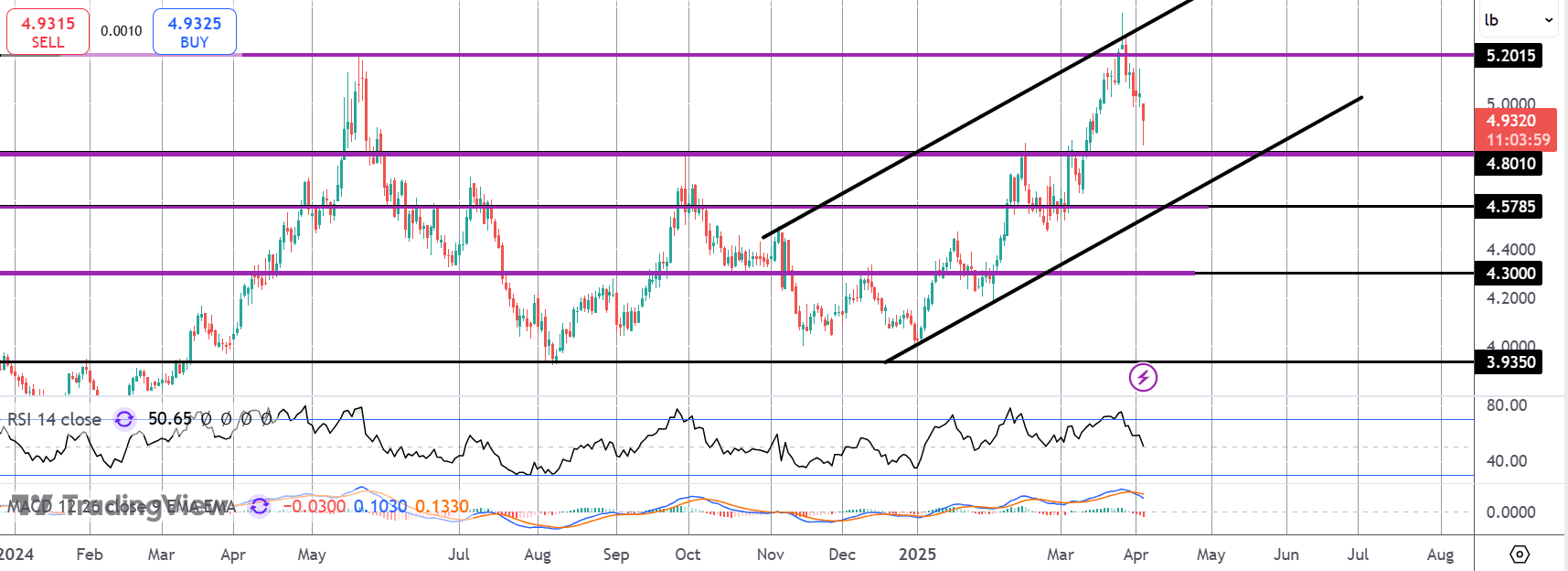

The breakout move in copper has stalled with price since reversing back under the 5.2015 level. For now, the 4.8010 level is holding as support and with price still within the bull channel, the focus is on a fresh push higher. Below 4.8010, 4.5785 is the next support to note, along with the channel lows.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

With 10 years of experience as a private trader and professional market analyst under his belt, James has carved out an impressive industry reputation. Able to both dissect and explain the key fundamental developments in the market, he communicates their importance and relevance in a succinct and straight forward manner.