Bullish GBPUSD Risks Into BOE Today

-1726743070.png)

BOE Up Next

Following on from the Fed last night, the central bank spotlight falls on the BOE today. In contrast to the Fed, however, the bank is widely expected to keep rates on hold. The latest inflation data released this week showed that annualised CPI held steady at 2.2% last month, following a rise to 2.2% from 2% over the prior month. With the deflationary trend having stalled for now and other indicators showing strength in the UK economy, the BOE is likely to allow more time to pass, and more inflation data to be received, before making any further policy adjustments.

BOE/Fed Divergence

Given the larger .5% rate cut actioned by the Fed yesterday, and the subsequent sell-off in the Dollar, there are upside risks for GBPUSD today. If the BOE holds rates steady as expected, this divergence between the two central banks should see GBPUSD breaking out to fresh highs today. Moreover, if the tone of the BOE’s guidance is deemed less dovish than previously, this could well dilute easing expectations over the remainder of the year. In this scenario we can expect the pair to move firmly higher, particularly given the dovish revisions to the Fed dot plot forecasts we saw yesterday. Additionally, the announcement of the plans for QT today also presents some hawkish risks that could amplify buying in GBPUSD through the end of the week.

Technical Views

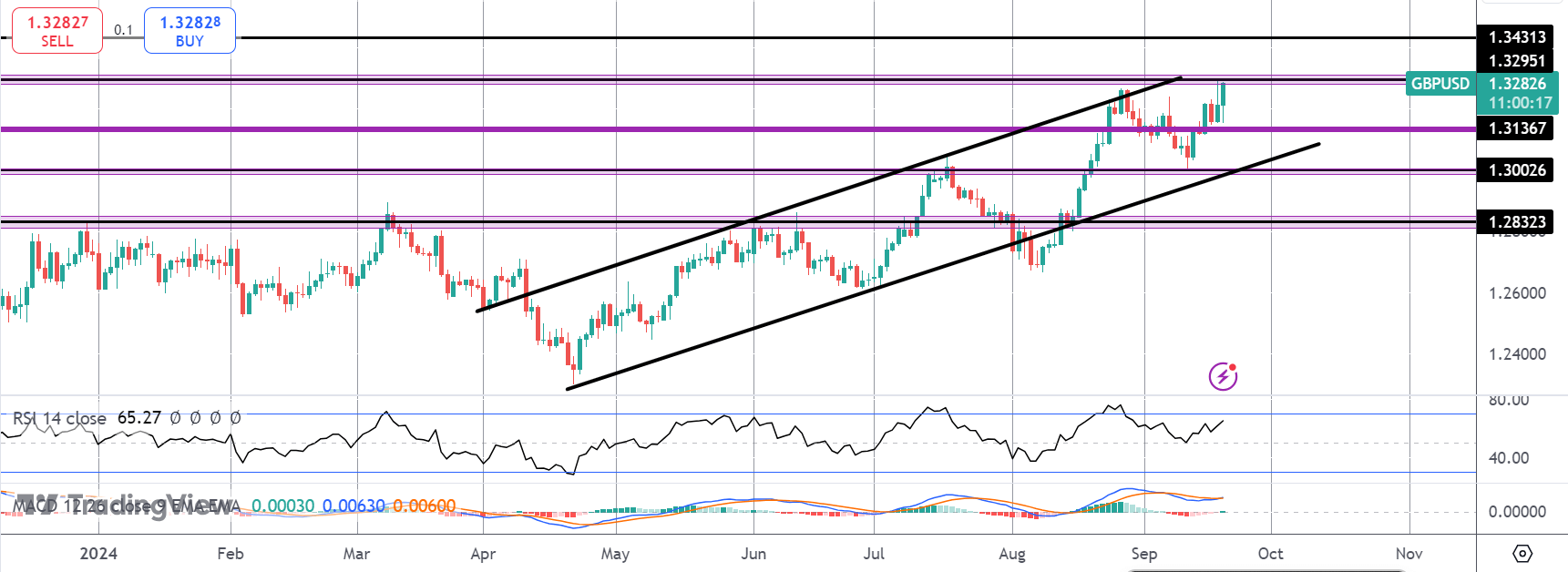

GBPUSD

The rally in GBPUSD off the 1.30 level has seen the pair trading back up to test the 1.3295 level. With momentum studies turning higher again, focus is on a breakout above current resistance and a continuation towards 1.3431 as the next bull objective. In the Signal Centre today we have a buy limit at 1.3160 suggesting a preference to stay long into any corrective pullbacks from current levels.

.png)

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

With 10 years of experience as a private trader and professional market analyst under his belt, James has carved out an impressive industry reputation. Able to both dissect and explain the key fundamental developments in the market, he communicates their importance and relevance in a succinct and straight forward manner.