Bitcoin Drifting Without Action from Trump

Bitcoin Demand Fading

It’s been a soft start to the week for Bitcoin with the futures market in the red across early European trading on Monday. A stronger-than-forecast US inflation print last week, sizeable ETF outflows, and an absence of any pro-crypto noise from Trump are weighing on sentiment here. The continued uptick in US inflation is casting doubts over the prospect of near-term Fed easing.

Fed Expectations

Pricing is currently split around the potential for a cut in June or July but with neither month priced convincingly, the uncertainty in the market is clear. If traders get the sense that a near-term cut isn’t coming (likely in response to any further CPI increase), this could weigh heavily on the broader risk complex, driving BTC lower near-term. Indeed, this view already looks apparent in the large ETF outflows we’ve seen over the last two weeks.

Bulls Waiting on Trump

Another key headwind for Bitcoin bulls currently, is the lack of attention from Trump in terms of pro-crypto policy. Over the course of Trump’s campaign, the president sounded aggressively in favour of bolstering the crypto sector, with many Bitcoin bulls hoping for immediate action from Trump. However, over the first month of his new term, Trump’s focus has clearly been elsewhere, creating frustration among Bitcoin bulls. Current price action suggests that large players are holding on, still anticipating that at some point Trump will turn his attention to Bitcoin, specifically a strategic US Bitcoin reserve, at which point the market will take off again. However, if this doesn’t materialise, or if time continues to drag on, BTC is vulnerable to a deep correction lower.

Technical Views

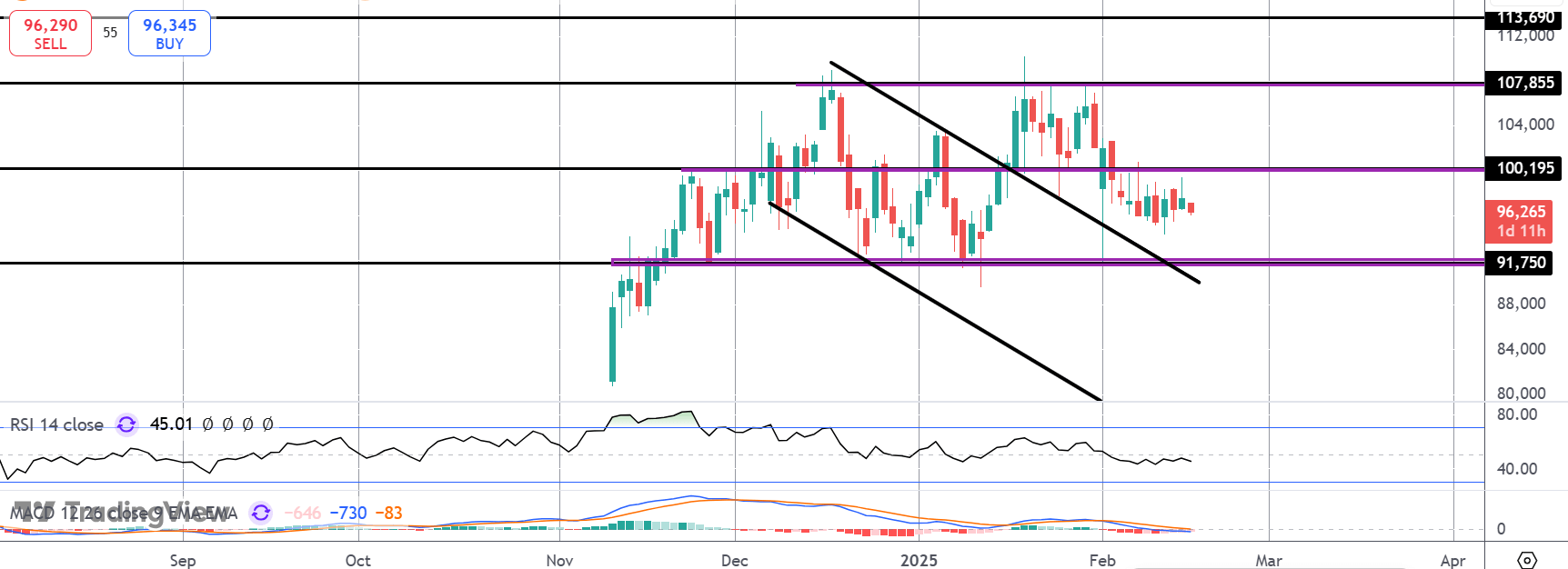

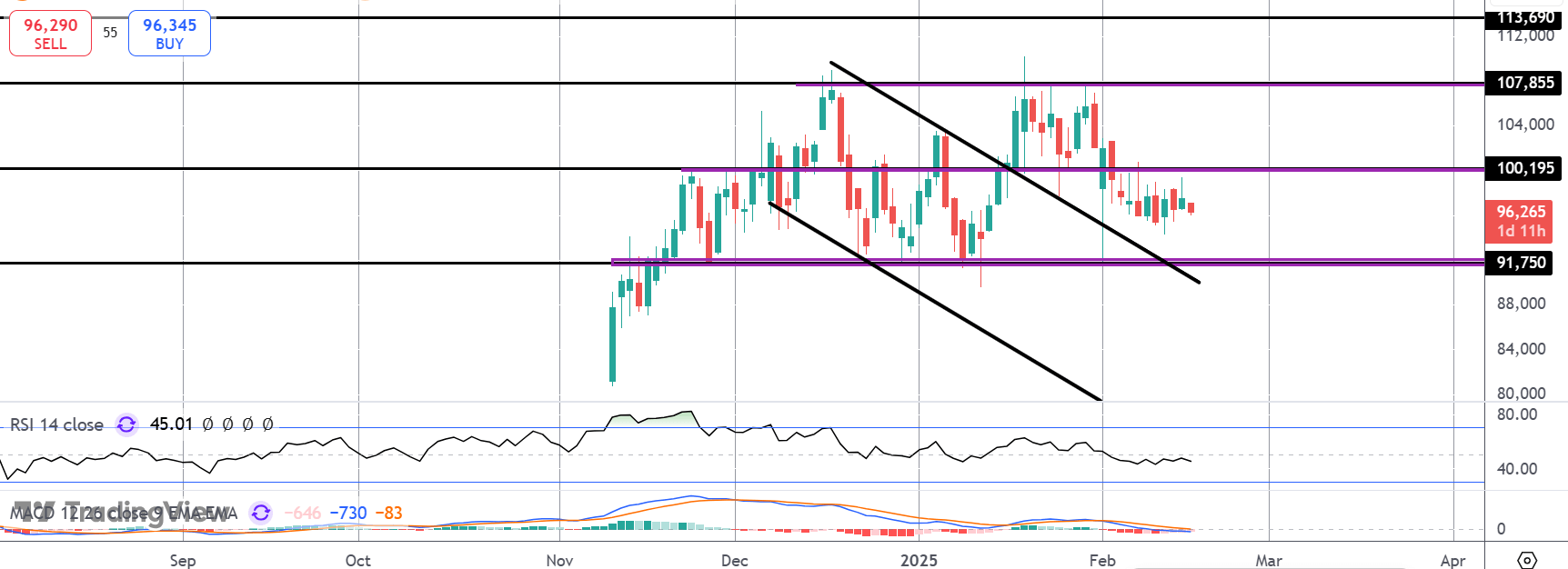

BTC

For now, the market remains capped below resistance at the $100k mark but still above the $91,750 level which has underpinned the market since late November. While current support holds, the longer-term bull trend remains intact and focus is on a fresh push higher. Below support, focus shifts in favour of a deeper correction.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

With 10 years of experience as a private trader and professional market analyst under his belt, James has carved out an impressive industry reputation. Able to both dissect and explain the key fundamental developments in the market, he communicates their importance and relevance in a succinct and straight forward manner.