Big Negative Surprise From the Conference Board. What are the Takeaways for the NFP?

Greenback struggles to take off from the 92.50 support level ahead of US labour data for August. DXY rallied on Tuesday thanks to the outflow from Treasuries market as distant bond yields apparently rose in response to hawkish remarks of some ECB officials. The 10-year yield rose from 1.27% to 1.35% as the ECB policymakers hinted that it may be appropriate to start tapering of special asset purchase programs (the so-called PEPP). Given that the major central banks try to keep up with each other in terms of policy easing and tightening, this were interpreted as a hint that the Fed may be more eager to taper than previously expected.

More specifically, here is a statement by the head of the Danish Central Bank, Knot: "The inflation forecast in the Eurozone has improved markedly and justifies an immediate reduction in PEPP, a complete curtailment of the program in March 2022 and a return to pre-crisis discipline in policy."

However, Nomura's latest forecast does not anticipate a shift in PEPP until at least March 2022:

The ECB is due to holding a meeting on Thursday, September 9 and based on emergence of hawkish rhetoric, there is growing risk that Lagarde will hint that PEPP cannot last forever. In anticipation of this surprise, the euro may extend gains against its peers, given that now the European currency has very low expectations for tightening, since the ECB until recently refrained from hawkish hints in every possible way.

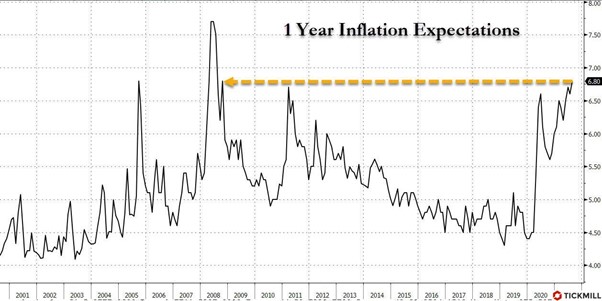

Ahead of the NFP, markets are closely watching data that may indirectly indicate a change in employment in the reported month. Among important indicators, one can single out the consumer confidence indices, the dynamics of which is tied to income and income expectations of households. Yesterday was published a report on consumer confidence from the Conference Board, which decreased compared to the previous month (129.1 against 113.9 points). In addition, the index did not live up to expectations and also came below the most pessimistic forecast. We can recall the depressing dynamics of the index from U. of Michigan in August (drop by 10 points), which may also indicate a tipping point in consumer sentiment and expectations in August. In general, consumer sentiment is deteriorating and either this is the result of expectations of sharply increased inflation or worsening income outlook. By the way, one-year inflation expectations, calculated on the basis of the report, rose to 6.8% - this is the maximum since 2008:

Source: ZeroHedge

It is clear that high inflation starts to negatively affect consumer decisions, from this point of view, it is time for the Fed to curb stimulus measures, since it is more and more difficult to assert about the temporary nature of inflation and this may at some point result in a loss of confidence by market participants in the Fed's actions, which is fraught with increased policy costs.

The Conference Board report, together with the Michigan report, suggests that we will face moderate job growth in the United States. Nevertheless, inflation dynamics indicate that the Fed will not be profitable to deviate from its implicit QE promises made in Jackson Hole. The combination of these events - a weakening economic outlook and a course to cut stimulus from the Fed risk negatively affecting stock prices, inducing correction from ATH.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 73% and 72% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.