Are Economy and Markets on Their own Again?

I wrote about consolidation and potential bearish breakthrough of stock indexes on Friday as we’ve got a kind of “void” after the Fed meeting and due to stalling fiscal talks. The Fed issued a gentle signal on the last meeting that it completed easing cycle while rumors on fast approval of fiscal aid have almost completely died down. The economy and markets appear to have been left on their own. There are really few bullish catalysts left (which should be realized by market bears as well helping them to add pressure) although tomorrow Powell may say something dovish when speaking in Congress.

Nevertheless, I don’t think current retreat in equities will turn into a bearish trend. In my view it is continuation of solid correction which grows the second leg. The "void" in the space of market hopes and expectations will be filled up sooner or later, but it’s clear that the updated Fed stance didn’t change bonds vs. stocks return story which had been driving stock market gains before the Fed meeting.

Negotiations on the fiscal deal have been complicated by the fact that Republicans and Democrats are opening a new front of opposition - the appointment of a new head of the US Supreme Court, after the previous head passed away last week.

It is important to remember that the "sauce" from the Fed lending facilities for the primary and secondary credit markets, incl. Main Street (all sorts of TALF, MMLF, PMCCF, SMCCF) at the ready. And the credit resources to keep credit spreads in check are enormous. If spreads widen dangerously the Fed will definitely intervene, so it may be useful to keep tab on junk bonds and commercial paper markets in order to predict possible Fed’s reaction.

But stock market bubbles and corrections are not something the Fed’s monetary policy should care about. We’ve got a hint about it from the Fed member Brainard and it means that monetary policy decisions will be less and less focused on managing stock markets.

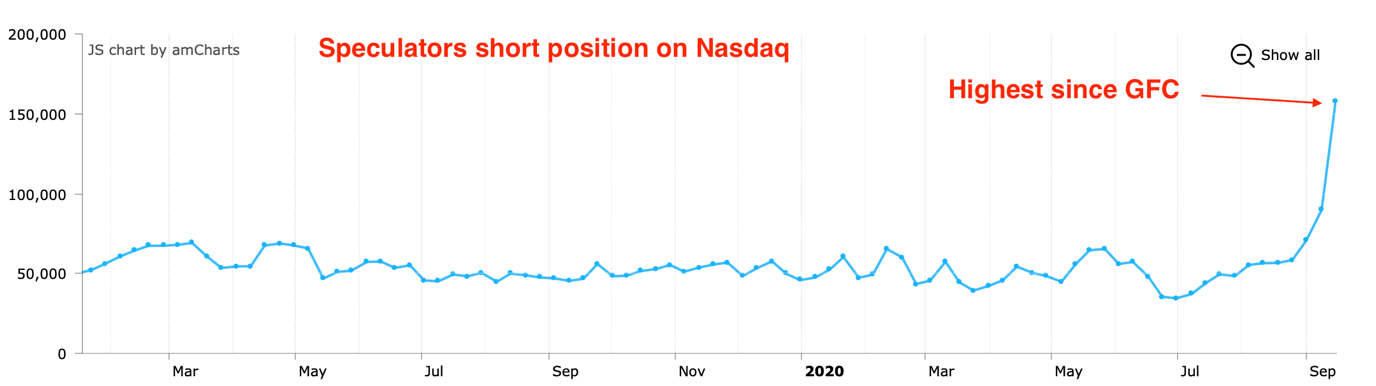

Meanwhile, the speculators' bet on the fall of Nasdaq in just a few weeks has risen to its highest value since the 2008 financial crisis ...

…and it’s unlikely we’ll see a quick recovery of optimism in the market, and in my opinion the mini bearish trend will last for at least a week.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 73% and 76% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.