Chart of the Day NZDJPY

Chart of the Day NZDJPY

NZDJPY Running Out Of Steam

The broad USD steadied after consecutive days of decline, with the DXY index back above the 99.00 mark. The greenback saw gains against the EUR complex, with the EUR retreating back towards the 1.1000 handle, and the GBP below 1.2400. CAD underperformed across the board on softer crude (WTI flirting with $20/barrel). The antipodeans, especially the AUD, was more resilient against the USD. This week, overall risk sentiment has continued to stabilize.

Looking across the sub-indices, noteworthy generalised relief across most, if not all, asset classes compared to last week. However, the notion of the worst is yet to come cannot be ruled out just yet, with the macroeconomic trajectory pointing further south. Although China March official PMIs were relatively supported this morning (the initial hit was taken in the Feb PMIs), the question is how deep other global PMIs will slump. This may become the trigger for another round of risk-off.

Notwithstanding month-end flows and short-term liquidity issues, the macro trajectory continues to look very weak, with more economic contraction to come. The upcoming slate of economic data releases may give the market a chance to re-focus on these issues.

From a technical & trading perspective the NZD continues to recover, mostly on the back of the latest Fed interventions, in which the central bank committed to unlimited QE. We've also seen Kiwi demand as risk sentiment ticks back up in response to optimism around the coronavirus peaking out. At the same time, there has been some Kiwi selling on Tuesday, from news coronavirus restrictions may remain in place for a long time in New Zealand. ANZ business confidence reads also haven't helped, after falling to a record low.

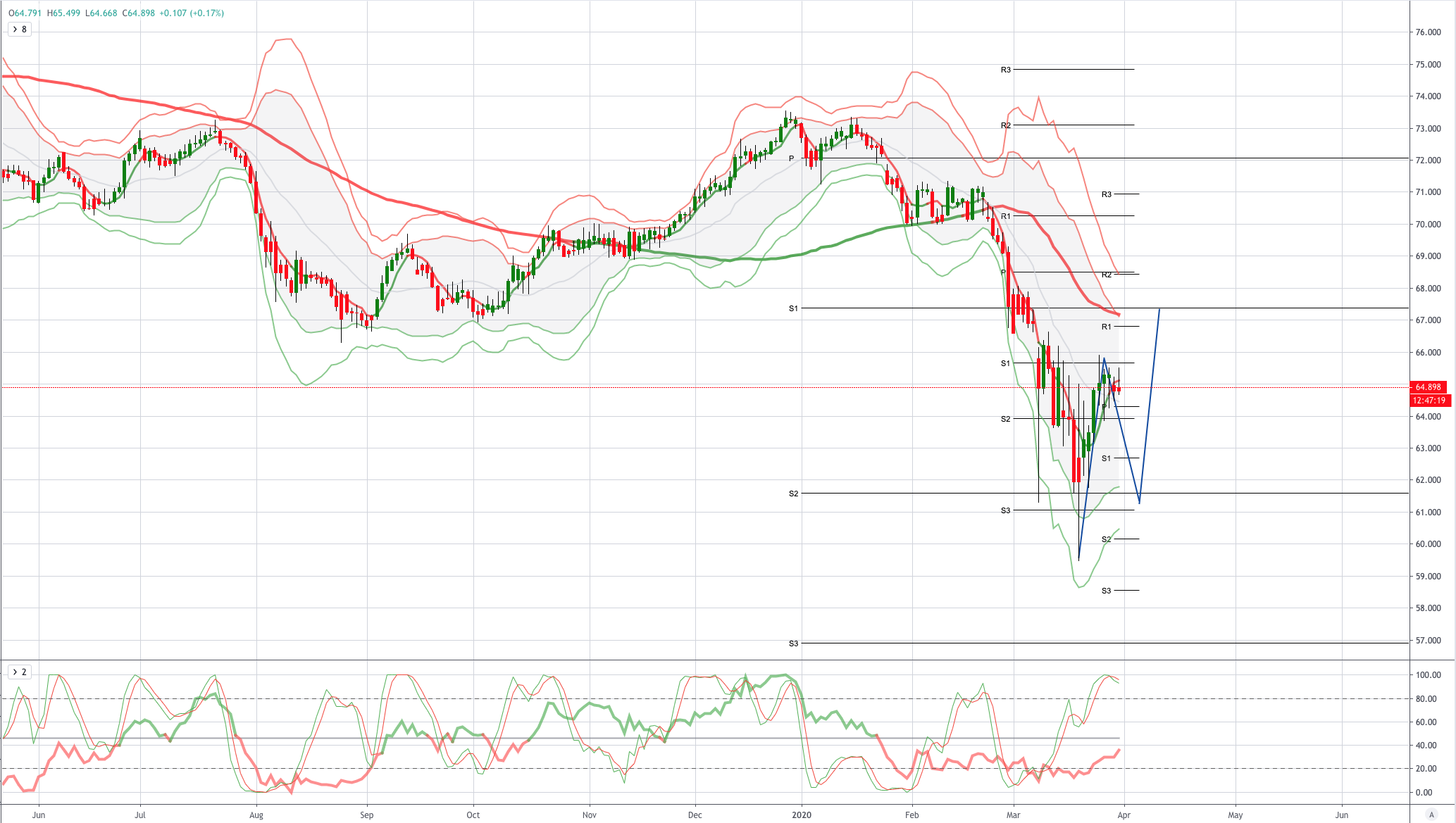

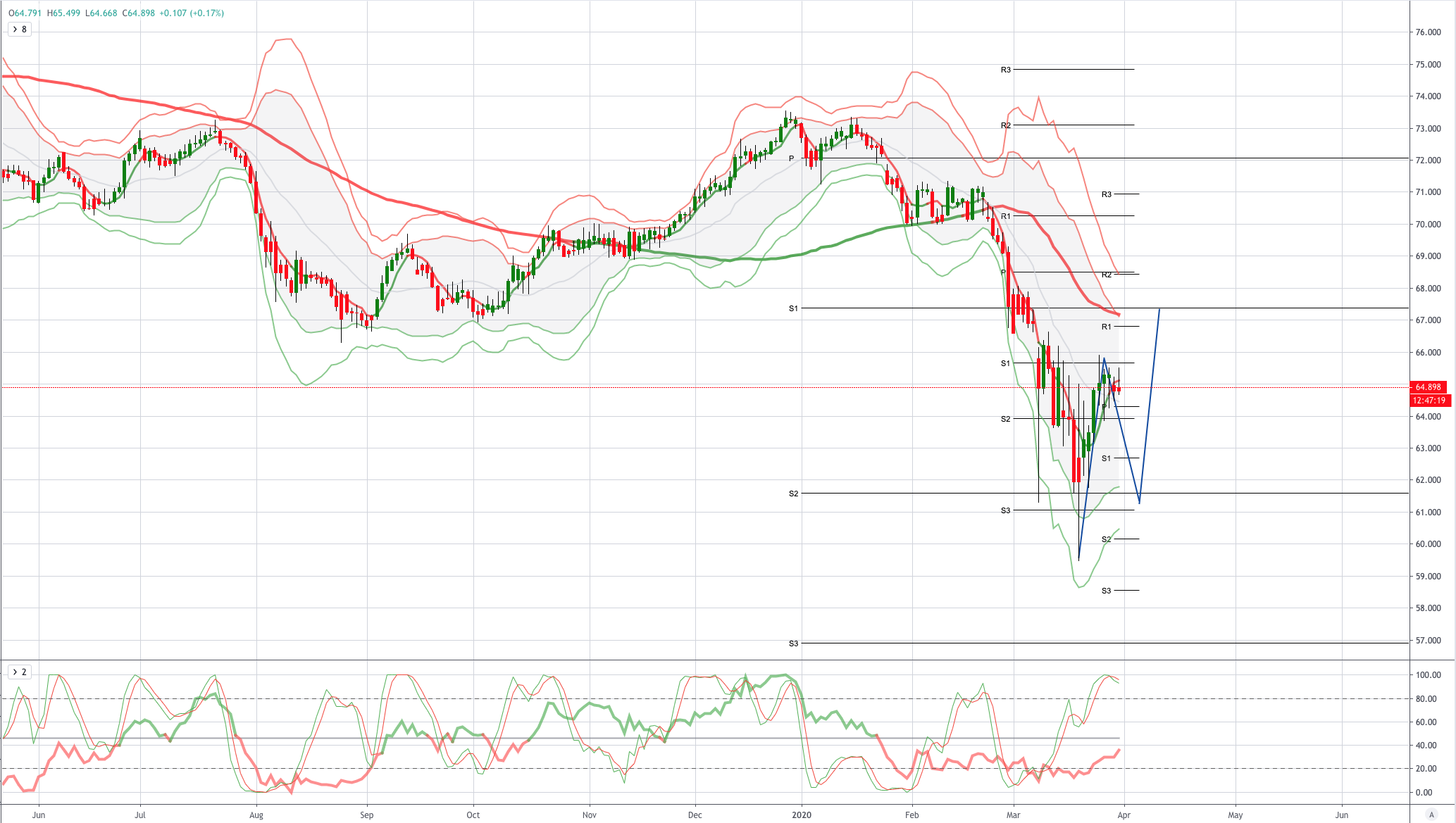

The NZDJPY looks vulnerable for a correction lower after the recovery it would appear that in the near term a pullback should develop to address the short term overbought conditions, the corrective thesis would gain support on a break of 64.16, a breach here could see a move to test support back towards 61.50, a decision point, if bids emerge here we could see another leg higher, a failure to find support would open a retest of the lows below 60.00

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 73% and 70% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

Patrick has been involved in the financial markets for well over a decade as a self-educated professional trader and money manager. Flitting between the roles of market commentator, analyst and mentor, Patrick has improved the technical skills and psychological stance of literally hundreds of traders – coaching them to become savvy market operators!