The IndeX Files 01-10-2019

Equities Upside On Hold

Global benchmark indices have commenced the week in rather a subdued fashion with most headline indices having retraced from recent highs.

In the US, the equities landscape is dominated by fluctuating Fed rate hike expectations. With recent data supporting, the market has reduced its outlook for an October rate-cut, instead deeming December the next likely point at which the Fed might cut rates again. Looking ahead this week, the US Non-Farm Payrolls, Unemployment rate and Wage Growth released on Friday will be the key economic events to watch. Should we see any weakness in these reports, pricing for Fed rate cuts across the remainder of the year should increase, keeping equities underpinned. On the other hand, positive readings will keep rate cut expectations subdued, leaning on equities.

In Europe, data weakness in Germany and the Eurozone as a whole has compounded the view that the ECB will maintain an easing profile across the rest of the year. Last week, disappointing PMI releases showed all sectors moving into contractionary territory. Today, the release of Eurozone CPI came in lower than expected keeping expectations of further ECB easing in focus.

The UK backdrop remains highly Brexit-centric. Data released yesterday showed that UK GDP had been revised higher over the first quarter though the reading for the 2Q showed a bleak 0.2% contraction. This data comes just after BOE MPC member Saunders recently warned that the BOE could be forced to cut rates even if we see a Brexit deal, or even ahead of Brexit due to the damage caused by economic uncertainty. This data has done little to dissuade from this view.

Asian indices remain very much linked to the outlook for the next round of US – Sino trade meetings scheduled to take place this month. Any signs of a deal, or even positive momentum, should help keep equities benchmarks bid. A further stalling in negotiations, however, could see sharp reversals lower across the equities space.

Technical & Trade Views

DAX (Neutral, Bullish while 12125 supports)

From a technical and trading perspective. The market continues to range between the yearly pivot between the 11490 level and the year R1 at 12689. In line with longer-term VWAP, an eventual break higher remains my preferred play. However, if w do fade lower from here, I will be monitoring any retest of the 11822 support for bullish reversal candles to initiate long positions.

S&P500 (Bullish above 2905, targeting 3031)

S&P500 From a technical and trade perspective. Price still signalling a drift back towards a retest of the highs around 2938. I will be monitoring price action as we test this level looking for reversal candles between here and the monthly pivot at 2905 to set longs for a renewed push higher towards the monthly R1 at 3031. If we work through bids at these levels I will reassess on a move deeper.

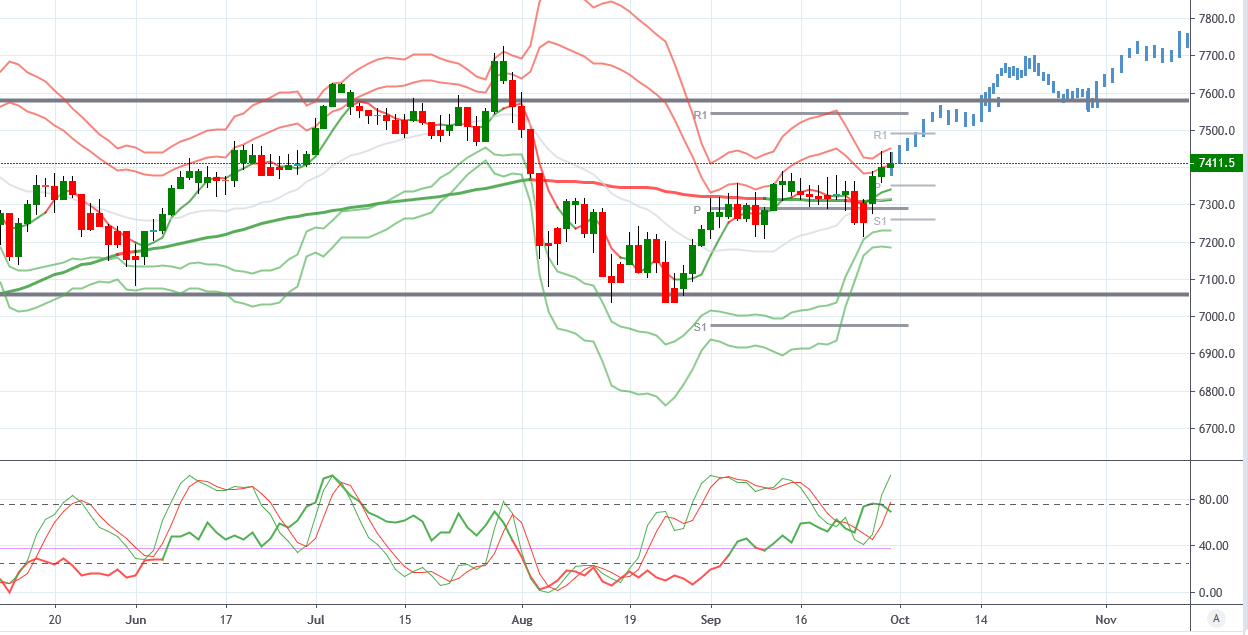

FTSE (Bullish above 7300, targeting above 7600)

FTSE From a technical and trading perspective. Price is trending higher now with VWAP supporting a test of offers into the 7577 yearly R1 level. My bias is for an eventual break and I will be monitoring price action if we move above the yearly R1 for long setups targeting beyond 7600.

Nikkei (Neutral, Bullish above 21167)

From a technical and trade perspective. Offers into the medium-range bearish trend line continue to stall upside. If selling pressure creates a pullback here, I will be watching for bullish reversal candles between 21545 and 21173 for longs targeting an eventual break above the trend line. Should any pullback run deeper than 21173, we are likely to see some ranging play around the yearly pivot.

Please note that this material is provided for informational purposes only and should not be considered as investment advice. The views discussed in the above video are those of our analysts and are not shared by Tickmill. Trading in the financial markets is very risky.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

Patrick has been involved in the financial markets for well over a decade as a self-educated professional trader and money manager. Flitting between the roles of market commentator, analyst and mentor, Patrick has improved the technical skills and psychological stance of literally hundreds of traders – coaching them to become savvy market operators!